Gold Price News and Forecast: XAU/USD – What does the valuable gold miners indicator say now? [Video]

by FXStreet TeamGold: The bulls cannot now sustain traction in a run higher [Video]

The control that the gold bulls had during July and early August has been lost. An uptrend that supported the run higher during the summer months has now been broken as a phase of neutral trading has set in. What we now see is that gold has developed a range between $1902/$2015. Anything into the low $1900s is finding support, but as the market again fell over on Friday, the bulls cannot now sustain traction in a run higher. Momentum has been neutralised, with daily RSI, MACD and Stochastics all around their neutral points. The 23.6% Fibonacci retracement (of $1451/$2072) at $1926 is still a key element of support (on a closing basis especially) and is seen as a key gauge. However the bulls seem to be increasingly misfiring. It was interesting to see the old$1955 pivot coming back in as a basis of resistance again on Friday. Read More...

What does the valuable gold miners indicator say now?

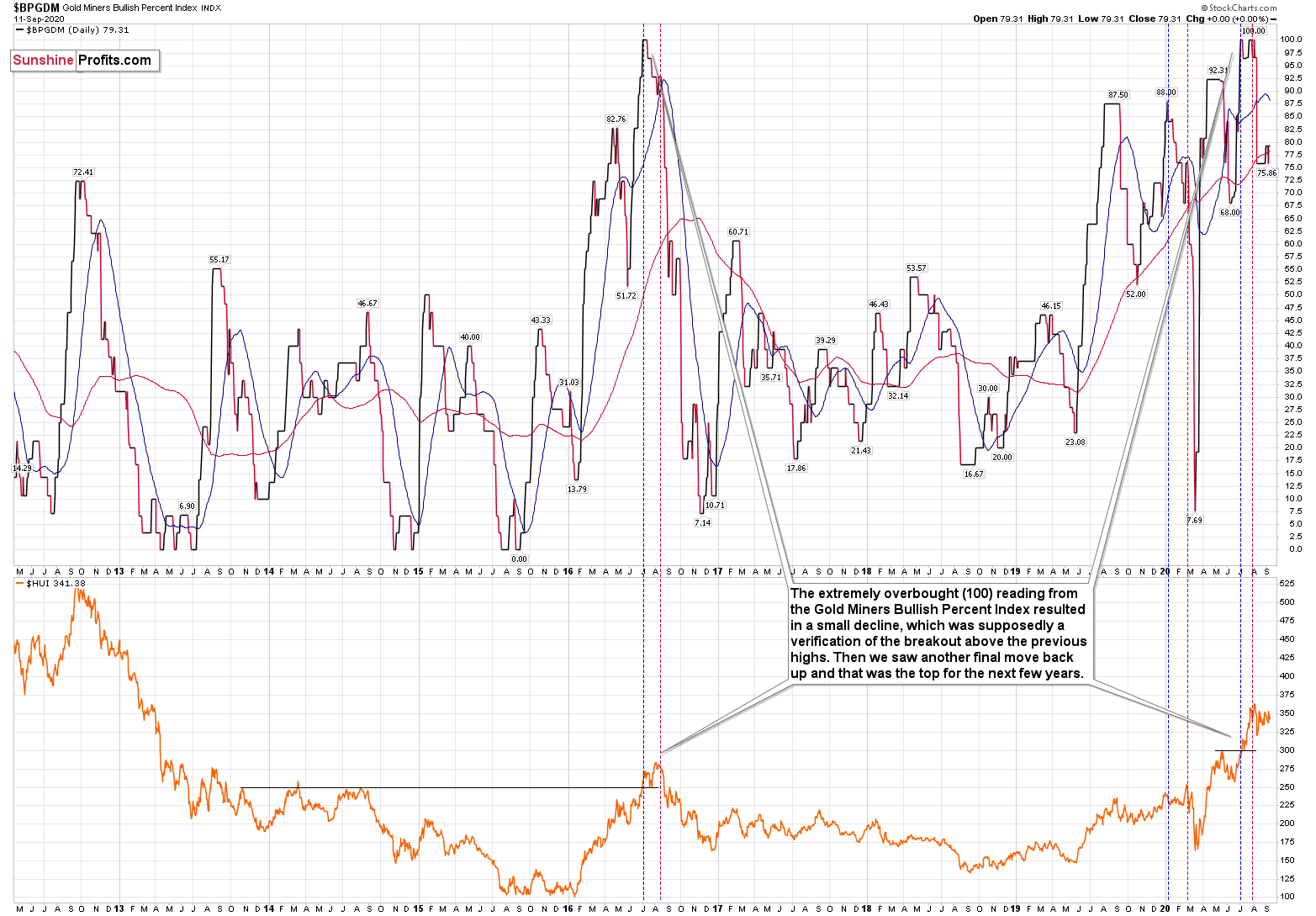

Some swear by price action, many others rely on indicators. There are actually many gold trading tips built around these techniques. Gold Miners Bullish Percent Index, is one of the rare ones that don't issue signals all that often. And it showed the highest possible overbought reading recently.

The excessive bullishness was present at the 2016 top as well and it didn't cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant. Read More...

Gold trades with modest gains below $1950 level, lacks follow-through

Gold edged higher on the first day of a new week and was last seen trading near the top end of its daily trading range, just below the $1950 level.

The prevalent selling bias surrounding the US dollar – amid doubts over the US fiscal stimulus measures – was seen as one of the key factors that benefitted the dollar-denominated commodity. The odds for a massive stimulus have fallen practically to zero after Democratic voted to block a Republican bill that would have provided around $300 billion in new coronavirus aid. Read More...

XAU/USD

| Overview | |

|---|---|

| Today last price | 1954.46 |

| Today Daily Change | 14.08 |

| Today Daily Change % | 0.73 |

| Today daily open | 1940.38 |

| Trends | |

|---|---|

| Daily SMA20 | 1947.38 |

| Daily SMA50 | 1919.63 |

| Daily SMA100 | 1824.06 |

| Daily SMA200 | 1702.55 |

| Levels | |

|---|---|

| Previous Daily High | 1954.78 |

| Previous Daily Low | 1937.29 |

| Previous Weekly High | 1966.54 |

| Previous Weekly Low | 1906.62 |

| Previous Monthly High | 2075.32 |

| Previous Monthly Low | 1863.24 |

| Daily Fibonacci 38.2% | 1943.97 |

| Daily Fibonacci 61.8% | 1948.1 |

| Daily Pivot Point S1 | 1933.52 |

| Daily Pivot Point S2 | 1926.66 |

| Daily Pivot Point S3 | 1916.03 |

| Daily Pivot Point R1 | 1951.01 |

| Daily Pivot Point R2 | 1961.64 |

| Daily Pivot Point R3 | 1968.5 |