Saudi banks face squeeze on profitability

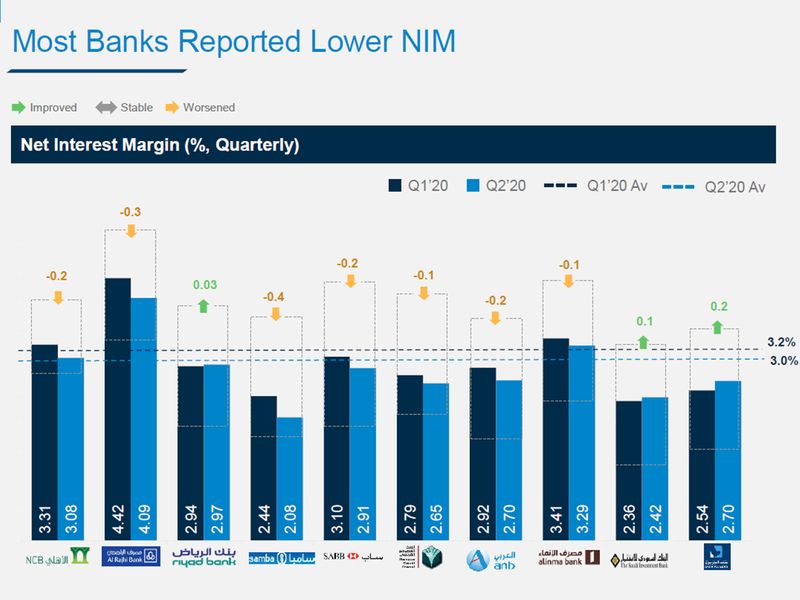

Provisions for impairments increase significantly as margins (NIM) continue to decline

by Babu Das Augustine, Business EditorDubai: The profitability outlook for Saudi banks remains subdued, as a result of the twin effects of low oil prices and Covid-19 lockdowns which might impact credit demand and asset quality according to Alvarez & Marsal (A&M).

An analysis of financial results of top 10 Saudi banks in the second quarter by A&M showed profitability of Saudi banks for the frist half of 2020 impacted substantially by Covid-19.

“Despite the challenging stance on profitability, we believe Saudi banks are still intent on paying dividends for 2020 which could bind their pace of growth. The banks top-line growth is also challenged by the compression of their net interest margins, limiting income growth,” said Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services,

Balance sheet growth

Saudi Arabia’s top ten banks reported a marginal increase in deposits compared to the preceding quarter, which improved the banks’ funding position. In Q2, the loan to deposit ratio (LDR) increased slightly to 86.1 per cent.

Operating income declined by 3.8 per cent quarter on quarter (QoQ) as the sluggish economic environment impacted all income streams. Net interest income dropped 2.2 per cent QoQ, as reduced interest rates more than offset a marginal increase in loand and advances. Net fee income fell 18 per cent, as lockdowns impacted fee income generated from new business volumes and cards.

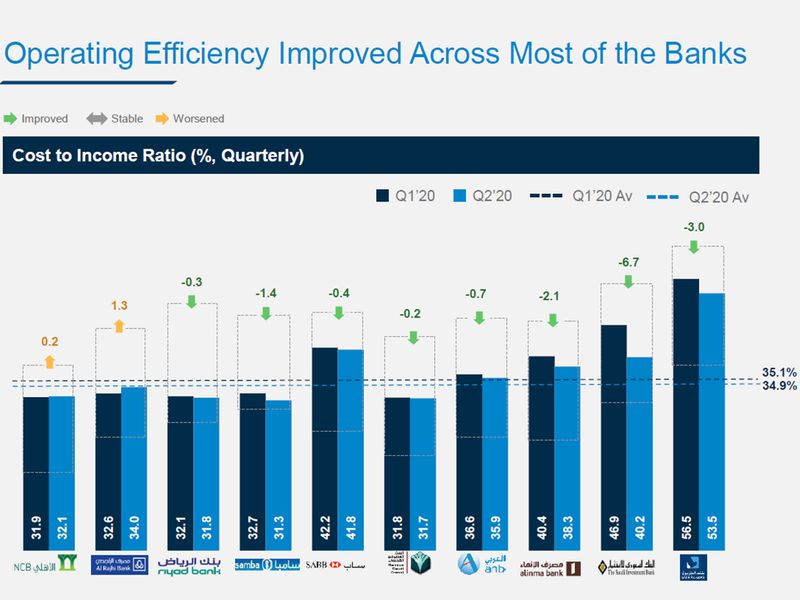

Efficiency improvements

The kingdom’s banks continued to improve their efficiency, as cost to income (C/I) ratio declined for the second consecutive quarter; a result of a regimented approach to cost optimisation and lower operational expenses during lockdown. Despite incessant decline, the C/I ratio still remains slightly above the average achieved in in 2019 (34.6 per cent).

Total operating expenses dropped 4.5 per cent QoQ, on the back of lower administrative and travel expenses incurred by the banks during the lockdown. Eight out of 10 banks reported a decline in their C/I ratio.

“We envisage that the top banks will maintain similar risk appetites but believe the pressures on their profitability and capitalisation will persist for the coming quarters, and only cost optimisation measures can support the banks’ viability,” said Ahmad.

Asset quality

The A&M report indicates that the provisions for impairments increased significantly for the banks that reported second quarter earnings. Total provisioning rose by 64.7 per cent quarter-on-quarter (QoQ) to SAR 5.1 billion in Q2 2020, continuing its volatile trend.

Coverage ratio declined for the fifth consecutive quarter to reach 146.2 per cent as a result of rise in the non-performing loans by 9.6 per cent. Depending on future macroeconomic factors, reserve building could continue in the approaching quarters.

Margin squeeze

Net interest margins (NIM) continued to decline, as system-wide rates touched multi-year lows. NIM fell by 18 bps to 3.01 per cent in Q2’20, largely due to 61 bps decline in yield on credit caused by the lower interest rate environment. Seven out of 10 banks reported a decline in the NIM.

Return on equity (RoE) of majority of the banks declined as reduced operating income and increased provisioning impacted bottom-line. Net income fell by 17.7 per cent on account of a dual impact from lower income and higher provisioning. As a result, RoE decreased from 12.5 per cent in Q1’20 to 10.3 per cent in Q2’20. Profitability has seen a deteriorating movement beginning Q4’19 for both the KSA’s and UAE’s banking sector.