Tesla shares jump more than 12% amid tech rebound, Goldman comments

by Pippa StevensKey Points

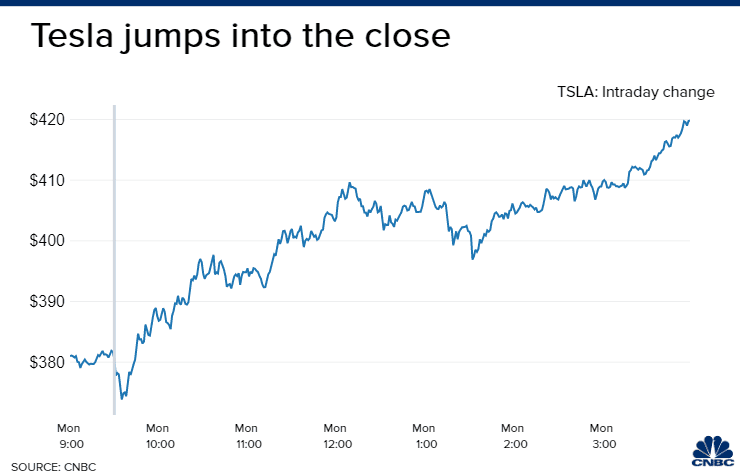

- Tesla shares jumped more than 12% on Monday amid a broad-based rally in the technology sector, and as Goldman Sachs said that demand is picking up in China.

- "Tesla global weekly app downloads have recently been tracking up on a year-over-year basis, with the most recent full week of global data up about 20% yoy," the firm said in a note to clients Monday.

- Shares of Tesla are about 16.5% below their Sept. 1 all-time high.

Tesla shares jumped 12.58% on Monday amid a broad-based rebound in the technology sector, and as Goldman Sachs said that demand is picking up in China.

"Tesla global weekly app downloads have recently been tracking up on a year-over-year basis, with the most recent full week of global data up about 20% yoy," the firm said in a note to clients Monday, while noting that the company typically has "much stronger deliveries in the last month of each quarter."

Still, the firm has a neutral rating on shares of the Elon Musk-led company, and a 12-month price target of $295.

Monday's move continues a period of volatility for the stock, which has seen it swing between sharp gains and losses. Last Tuesday shares dropped 21% for their worst day on record after S&P Dow Jones Indices decided against adding the stock to the S&P 500. The very next day, the stock jumped nearly 11%.

Monday's move also came on the heels of strength in the broad technology sector. The Nasdaq Composite advanced 1.87%, after posting its worst week since March. Apple gained more than 3%.

Tesla shares are up roughly 400% this year, but they're also about 16.5% below their record high from Sept. 1.

In addition to exclusion from the S&P 500, shares have come under pressure after the company announced it was raising $5 billion through a new stock offering, and after the company's largest outside shareholder trimmed its position.

- CNBC's Michael Bloom contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.