Plug Power Is in the Driver’s Seat as Hydrogen Use Grows

Mega deals for Plug Power from companies like Walmart and Home Depot are set to lift PLUG stock further

The trading volume of Plug Power (NASDAQ:PLUG) stock surged after the market learned that D.E. Shaw holds a passive stake in the company. The fund’s 5% stake in Plug Power is a vote of confidence in the management team and the company.

The investment firm has an incredible track record. Last year, spurred by its strong performance and high investor demand for its services, the fund even raised its management fee to 3% from 2.5%. The fund, meanwhile, raised its performance fee from 25% to 30%.

Plug’s Shares Shrugged Off Its Quarterly Loss

For the second quarter, Plug posted gross billings of $72.4 million. It also reaffirmed its 2024 financial target of $1.2 billion of revenue and $200 million of operating income. Conversely, its inventory increased to $114.6 million from $72.4 million last year.

Plug’s net revenue rose to $68.1 million, but its cost of revenue grew at a faster pace, climbing from $46.9 million during the same period a year earlier to about $63 million. Plug’s Q2 loss more than doubled year-over-year to $26.4 million.

Opportunities in the Hydrogen Market

Plug is in discussions with multiple local governments about obtaining funding for its hydrogen factory which it calls a Gigafactory. On the company’s Q2 earnings conference call, Plug CEO Andrew Marsh said it had already started purchasing equipment for the plant.

Plug expects its billings and EBITDA to increase, and it anticipates that the plant will help boost its margins to around 35%.

Marsh said that, as the cost of renewable energy falls, “hydrogen generated from renewables will be on a variable basis, cost-competitive with natural-gas generated hydrogen.” If Plug Power can obtain renewable energy for 4 cents per kilowatt-hour, it will likely be able to generate profits from “green hydrogen.”

In the hydrogen-trucking market, Plug Power is partnering with four truck makers. Once it releases the details of those deals, the market will have another reason to buy PLUG stock.

A New Deal with Walmart

Plug recently announced a deal to provide hydrogen fuel cell solutions to Asda, a UK-based supermarket. Asda is a wholly-owned subsidiary of Walmart Inc. (NYSE:WMT). Since Walmart owns businesses around the world, it may make additional overseas deals with Plug. So Plug’s overall revenue from the huge retailer could increase meaningfully in the longer term.

In addition to Walmart, Plug Power also has deals with BMW (OTC:BMWYY), Amazon (NASDAQ:AMZN), and Home Depot (NYSE:HD). By obtaining contracts from the world’s biggest online retailer and the largest food retailer in the world, Plug has put itself in very good position to continue generating rapid growth.

PLUG stock has nearly tripled since June when it changed hands for just over $4.00. If the company’s losses scare off investors, causing its share price to drop, PLUG stock could become much more appealing.

Meanwhile, Plug’s network of hydrogen-fueling stations is expanding. It has already built and operates over 100 stations. As concerns about the environment grows, the demand for green hydrogen will likely increase, too.

Plug’s Valuation

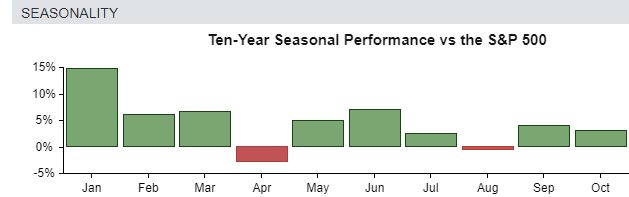

In September and October, Plug Power’s shares have performed quite well on a historical basis. If the pattern repeats, then the stock should rise modestly in the next six weeks:

The chart was obtained from Stock Rover

The Bottom Line

The percentage of shares of PLUG stock that is being sold short is high at nearly 15%, according to Stock Rover. A sharp drop in demand for the stocks of growth companies may send the shares lower. If Plug Power dips significantly below its current levels, investors should consider buying its shares.

Disclosure: On the date of publication, Chris Lau did not have (either directly or indirectly) any positions in the securities mentioned in this article.