Buy Or Fear Delta Airlines Stock?

by Trefis Team

In Delta Airlines stock (NYSE: DAL) we see more buying opportunity than a reason to fear. Specifically, there is about 80% upside potential if the stock recovers from $32 currently to its pre-crisis levels of $59. We provide an overview of why we think Delta should outperform by looking at its relative performance over the 2008 crisis, its current liquidity position, and financial performance versus other airlines. Our dashboard Delta Airlines Is Trading Cheaply briefly summarizes why Delta is a good buying opportunity.

Stock Price Movement & Comparing With 2008 Crisis

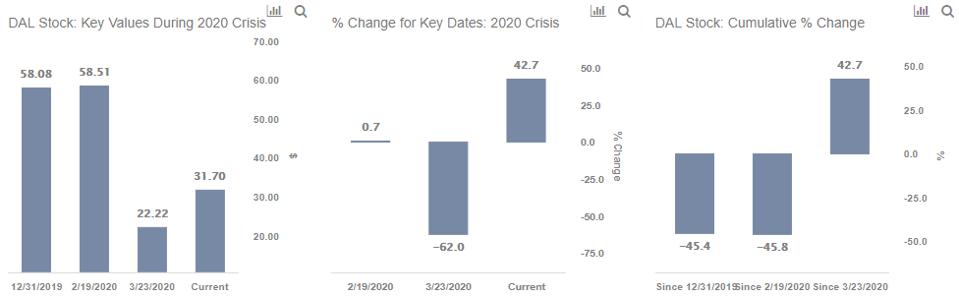

Delta’s stock trades at about $32 currently and has lost about 45% in value year-to-date, as demand for air travel declined sharply due to the Covid-19 outbreak. Delta traded at a pre-Covid high of about $59 in February and is currently 46% below this peak level. The stock has recovered 43% from the low of $22 seen in March 2020, driven by the government’s multi-billion-dollar bailout package for airlines and a gradual re-opening of the economy.

Looking at Delta’s performance during the 2008 crisis should also give investors a perspective of how the stock has rebounded from major sell-offs in the past. The stock fell from about $16 in October 2007 to a low of about $4.50 in March 2009 - losing about 70% of its value. However, the stock recovered considerably within a year - rising by over 120% from the March 2009 lows of $4.50 to about $10 in January 2010. See our dashboard How Delta’s Performance Over Covid-19 Compares With 2008 Crisis

Stronger Liquidity, Survival Prospects Compared To Rivals

Q2 2020 was a rough quarter for Delta, with Revenue down by over 80% year-over-year to about $1.5 billion and net losses coming in at about $5.7 billion due to restructuring charges and impairments to the tune of $4.5 billion. While demand has been picking up in recent months (with air passenger traffic in early September almost doubling compared to levels seen in early June) investors need to gauge whether Delta has adequate liquidity to survive a prolonged pandemic or perhaps even a stronger second wave of Coronavirus infections.

Delta boosted its total cash and short-term investments to about $16 billion at the end of the June 2020 quarter. Cash burn has also been largely contained, with daily cash burn declining to $27 million for the month of June compared to an average of about $43 million for Q2. [1] While Delta is targeting cash burn breakeven by the end of 2020, it has adequate liquidity to survive close to 19 months even if cash burn continues at the June rate.

In comparison, American Airlines reported an average daily cash burn rate of $55 million over Q2 with its rate standing at just under $35 million a day in June. The company had about $10 billion in cash as of June-end - implying that it can support cash burn at June levels for about 10 months. United Airlines, on the other hand, burned through about $40 million per day in the second quarter and reported cash and short-term investments of about $7.5 billion as of the June quarter - giving it just over 6 months before it runs out of cash at the current burn rate.

Looking Beyond The Coronavirus

Overall, Delta has a better liquidity position and a relatively longer cash runway compared to the other large airlines and this should largely mitigate concerns of survival. Moreover, the company had been performing well prior to the pandemic, with consistent revenue growth (about 19% in the last three years) and relatively higher operating margins (about 13.4% in 2019 versus 6.7% for American and 8.8% for United). Considering that air travel is an essential service that is likely to rebound fully as the pandemic subsides, the stock is likely to pick up considerably given Delta’s better fundamentals. Even if things remain tough, we think Delta is more likely than others to be helped by the U.S. Federal government, if needed.

So, Delta Airlines might give good returns from current levels. But what if you are looking for a more balanced portfolio instead? Here’s a top-quality portfolio to outperform the market, with over 100% return since 2016, versus 55% for the S&P 500, Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams