Top ETFs To Buy Amid Current Stock Market Correction

by Q.ai - Investing Reimagined

There was a correction in the U.S. markets with tech stocks faring the worst. The Nasdaq Composite lost over 4% this week with the Dow and S&P 500 down by 1.7% and 2.5% respectively. Energy stocks were also under pressure as the price of crude fell below $40. Lack of development in the stimulus package also hurt investor sentiments as Democrats opposed the $300-billion package. Demand for safe-haven long term Treasury bonds led to a drop in Treasury yields. Meanwhile, there was some friction between the UK and countries within the EU over terms of Brexit plans. Amidst the pullback in stock markets, Q.ai’s deep learning algorithms have identified a few ETFs based on the weekly flows this week. This includes one Attractive ETF, one Unattractive ETF, and 5 Top Short. These funds have seen a reversal in trend since September.

Vanguard Total Stock Market ETF (VTI)

The first name on our list today is Vanguard Total Stock Market ETF , a fund that invests in the U.S. equity market. It is overweight in the Technology sector with a high level of diversification across multiple sectors. The fund reports an AUM of $159.580 billion with a 90-day fund flow of $4.487 billion. Fund flow in the last week has also been positive with a figure of $0.920 billion. The net expense ratio stands at 0.03% and is probably one of the reasons that make it an Attractive ETF.

iShares Core U.S. Aggregate Bond ETF (AGG)

iShares Core U.S. Aggregate Bond ETF has been identified as an Unattractive ETF by our AI systems. Managed by BlackRock Fund Advisors, the fund is invested in investment grade fixed among instruments namely treasury bonds, government-related bonds, corporate bonds, mortgage-backed pass-through securities, commercial mortgage-backed securities, and asset backed securities. The 1-week fund flow has been $0.675 billion against a 90-day fund flow of $5.289 billion. AUM of the fund is $79.856 billion and the net expense ratio is at a reasonable level of 0.05%. The YTD return of the fund has been 5.34% and this performance may be difficult to replicate in the coming making months making it an unattractive proposition.

Top Shorts

There are five ETFs that have been rated as Top Short this week. These ETFs cover the equity and fixed income markets and have their portfolios invested in a broad range of instruments. Fund flows have been steady but some of these funds have seen the long term trend show signs of weakness.

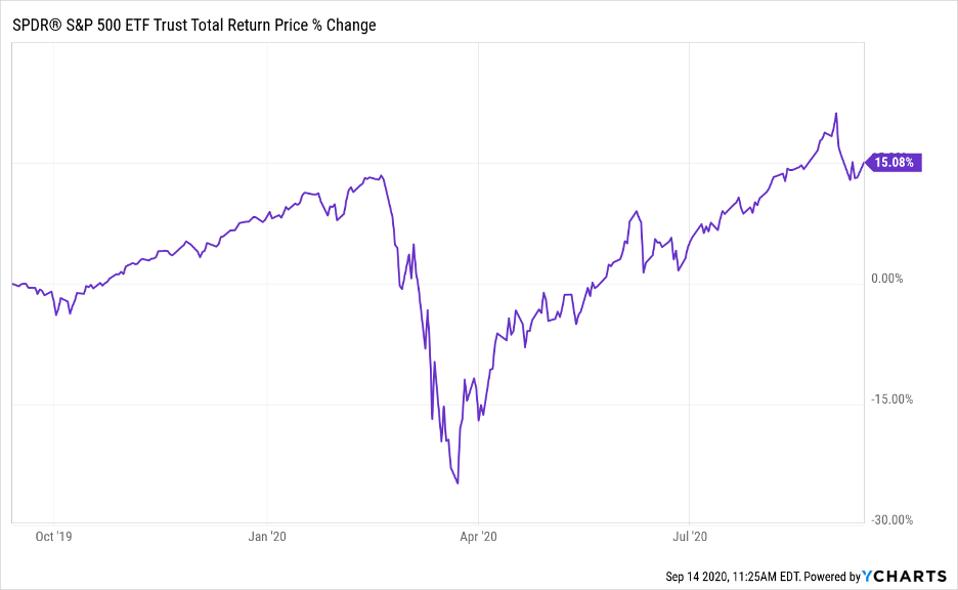

SPDR S&P 500 ETF Trust (SPY)

First on our list of Top Short ETFs is SPDR S&P 500 ETF Trust , a fund that closely tracks the S&P 500. It a 1-Week Fund Flow of $6.901 billion but investors have withdrawn $5.393 billion in the last 90 days. The AUM of SPDR S&P 500 ETF Trust is $297.759 billion and the net expense ratio is 0.094%. The price of the stock has gained by 11.26% in a year but there could be some selling pressure leading to a Top Short rating.

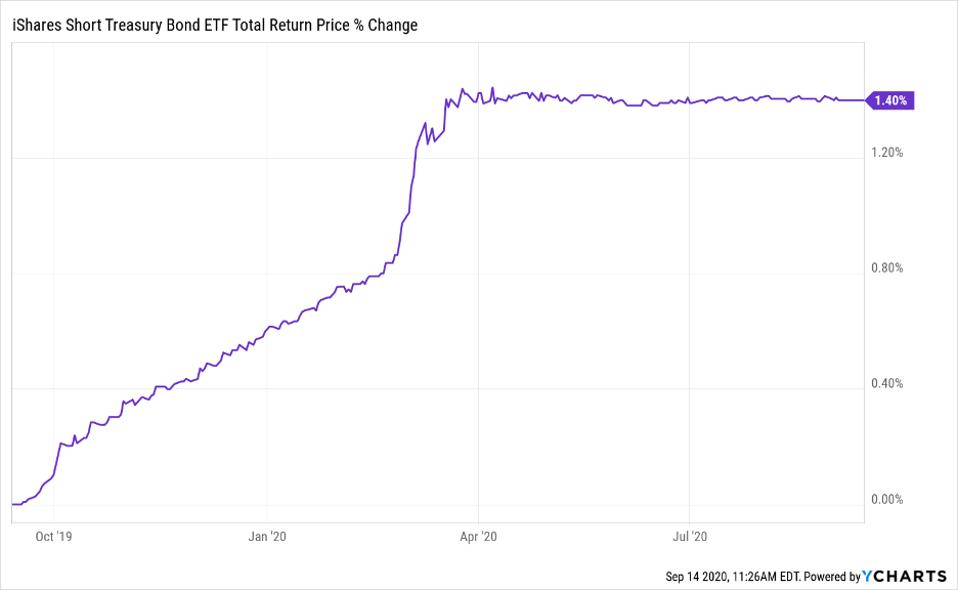

iShares Short Treasury Bond ETF (SHV)

iShares Short Treasury Bond ETF invests U.S. dollar denominated fixed rate treasury bonds with a remaining maturity of less than or equal to one year. The ETF has managed to generate a return of only 0.22% this year. With an AUM of $20.976 billion, the fund reports a 90-Day Fund Flow and a 1-week fund flow of -$1.960 billion and $1.251 billion respectively. The net expense ratio is on the higher side and is at 0.15%.

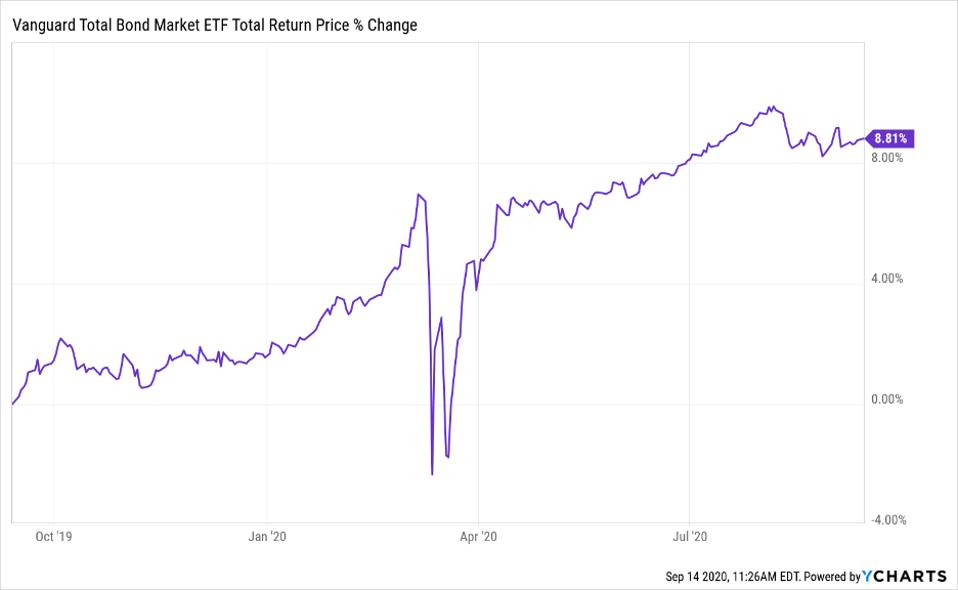

Vanguard Total Bond Market ETF (BND)

Vanguard Total Bond Market ETF has seen positive inflows of over the 1-week and the 90-day periods with the figures being $0.716 billion and $6.831 billion respectively. When considering an AUM of $61.765 billion, these fund flows can be considered as significant additions to the corpus. Net Expense ratio is at 0.05%. The fund looks to invest in investment-grade fixed income instruments. The ETF has benefitted from falling Treasury yields leading to an increase in its NAV as investors have been looking for safer assets. However, with rates already at extremely low levels, further appreciation in the price is not expected.

Vanguard S&P 500 ETF (VOO)

Another fund managed by the Vanguard Group features on our list. Vanguard S&P 500 ETF invests in equity markets of the U.S. and is diversified across all sectors with a slight bias towards technology. It looks to replicate the performance of the S&P 500 Index Fund flow for 1 week period was $0.502 billion and that for a 90-day period was 5.958 billion against an AUM of $159.279 billion. The Net expense ratio of the fund is at a low level of 0.03%. The return for the year has not been outstanding and there is a downtrend that is being observed of late.

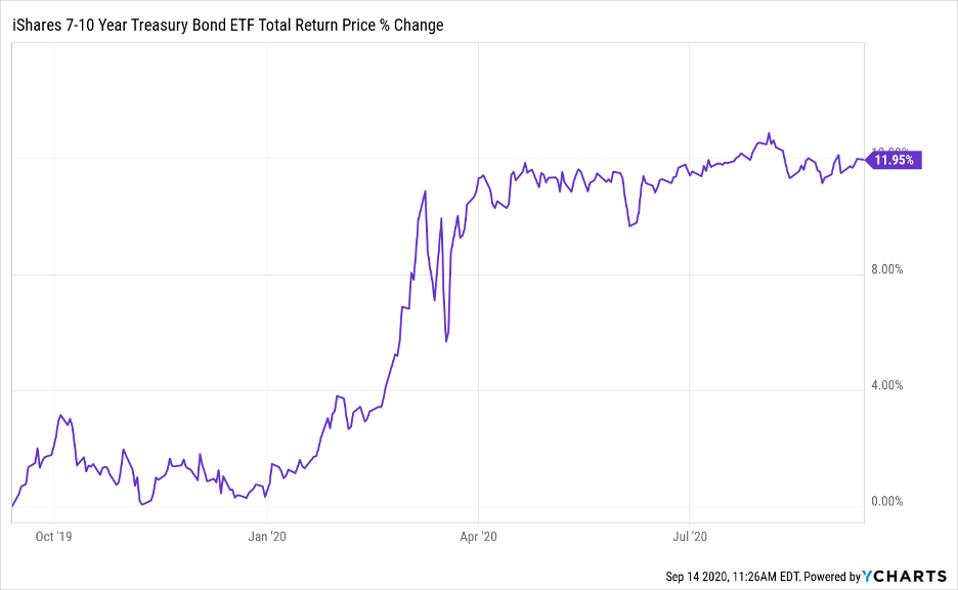

iShares 7-10 Year Treasury Bond ETF (IEF)

Finally, we have iShares 7-10 Year Treasury Bond ETF , a fund that has managed to generate a return of 11% approximately this year. It invests in treasury securities that have a maturity between 7 years and 10 years. Fund flow has been positive in the last week and stood at $0.450 billion with significant pressure on a longer time period. The ETF witnessed a withdrawal of funds worth $1.266 billion in the 90-day period. AUM of the ETF stands at $20.053 billion and it reports a net expense ratio of 0.15%. The combined effect of a high net expense ratio and the prospects of the bond market in the longer time frame makes it reasonable enough to assign a Top Short rating to this fund.