Listen Carefully, You’ll Hear The Fraud In The Details

by Dr. Augustine FouA.K.A. “How to Avoid Getting Scammed By Agencies and Ad Tech Vendors”

Apparent “bombshells” are dropping with increasing frequency lately. Last Friday brought news of fraud prevention startup NS8 being investigated for fraud by the SEC. Source: https://www.forbes.com/sites/davidjeans/2020/09/11/fraud-prevention-startup-ns8-fraud-investigation-sec

“NS8’s effective shut down comes just months after the company had announced a massive $123 million Series A round led by global VC firm Lightspeed Partners. That funding round valued the company at more than $400 million, according to data from startup tracker PitchBook.... The startup’s CEO, Adam Rogas, abruptly left the company last week” and hundreds of employees were laid off and informed of the SEC investigation via an all-hands Zoom meeting. Details are still scarce and “the SEC declined to comment.”

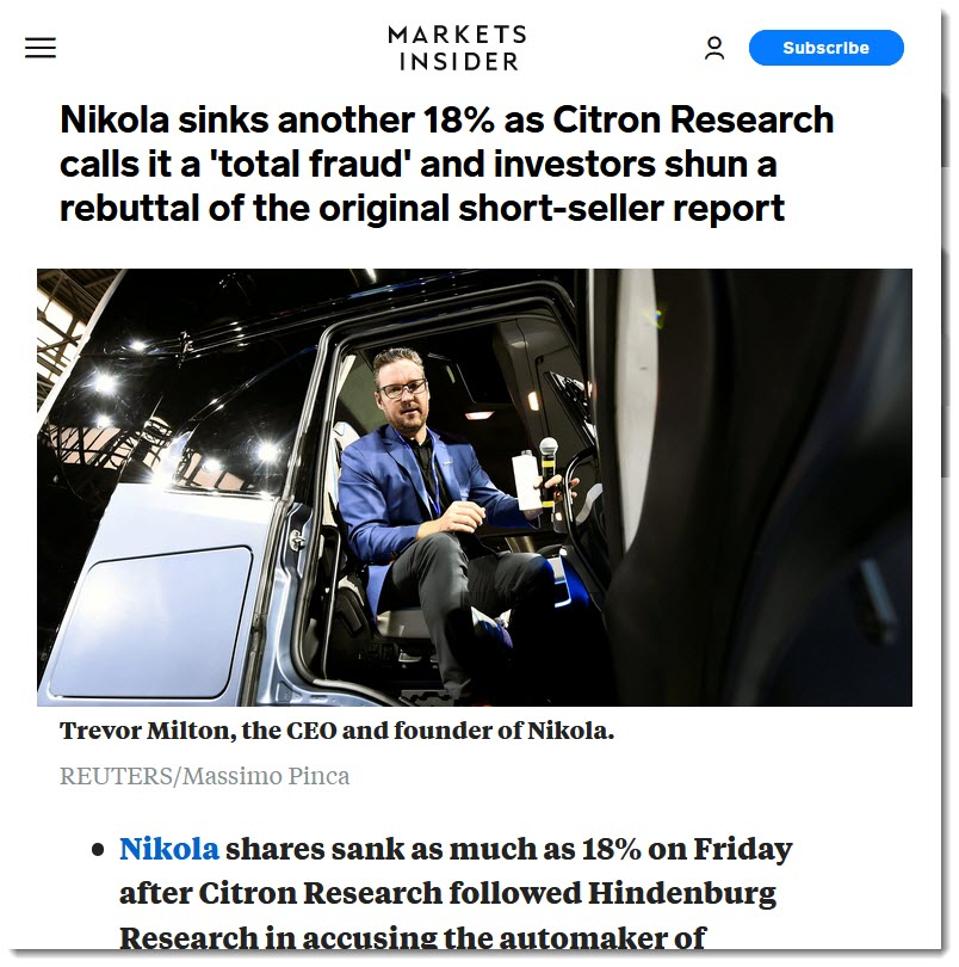

Last week also saw Citron Research and Hindenburg Research accusing Nikola, the hydrogen-electric automaker, of being a “total fraud” and “that Nikola engaged in several deceptive practices, from overhyping the capabilities of its electric semitruck to filling its multibillion-dollar order book "with fluff."

Of course, the above are allegations by motivated sources (short sellers) but the details of Nikola’s rebuttals are also very telling.

Source: https://www.cnet.com/roadshow/news/nikola-electric-hydrogen-truck-ran-trevor-milton/

“Nikola got very, very granular in its rebuttal, saying the company never said the One moved under its own power, or via a powertrain at all. Instead, the startup pointed out it simply showed the fuel-cell semi truck prototype "in motion" in a 2017 video.”

“[The] bombshell report said Nikola founder Trevor Milton essentially lied and maneuvered his way to big-name partnerships without ever actually producing any real products. The Hindenburg report, which accuses the startup of many other lies and mirages, dropped a day after General Motors inked a partnership to build Nikola's promised electric pickup truck and supply battery and fuel-cell hardware. The question surrounding the supplier details remains a curious one: Why would GM supply battery and fuel-cell hardware if Nikola touted a running prototype with its own proprietary technology three years ago?”

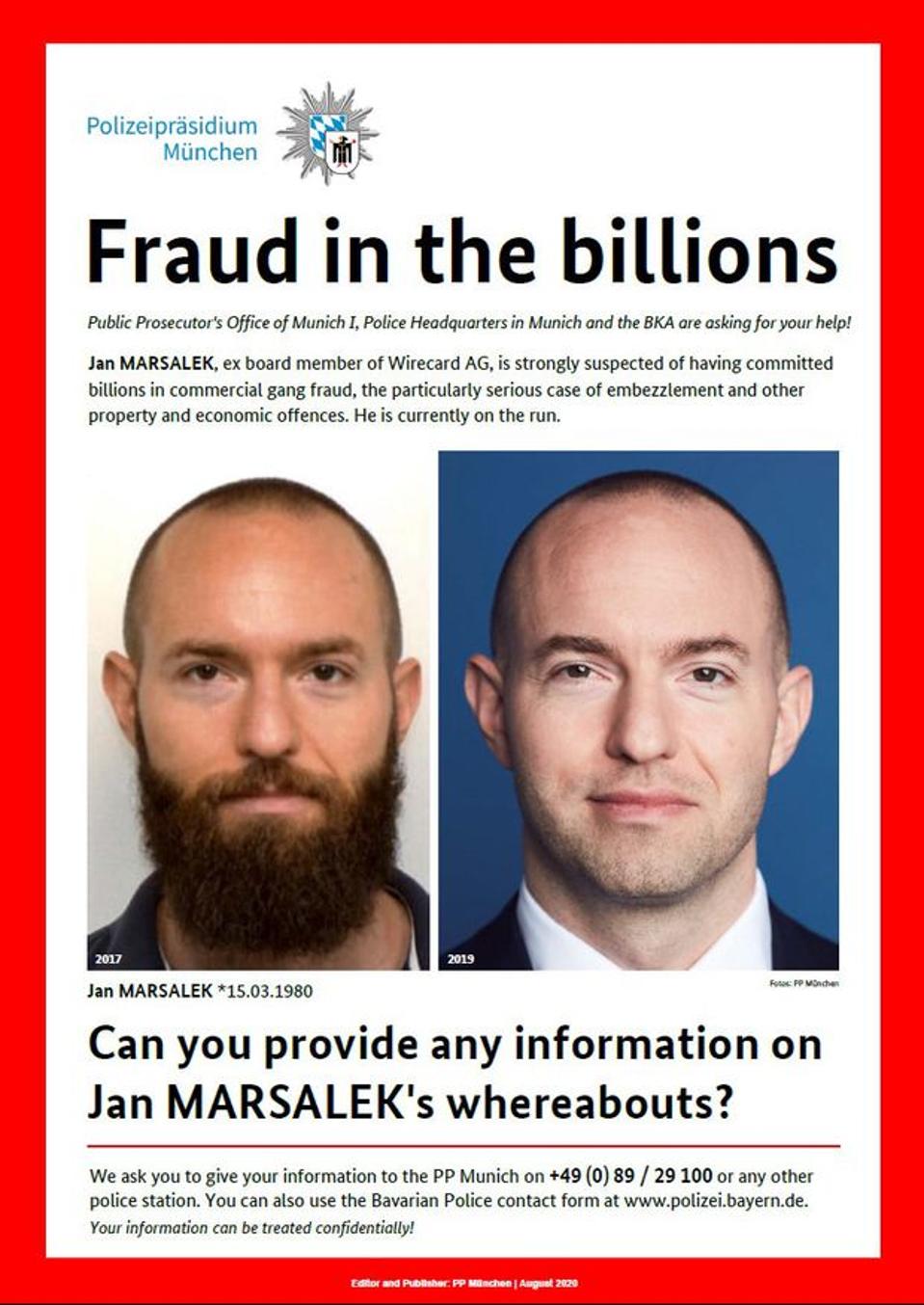

In June 2020, Wirecard’s former CEO was arrested, “accused of inflating the company’s balance sheet in an accounting scandal that centers on a missing sum of 1.9 billion euros ($2.1 billion).” Jan Marsalek, Wirecard former chief operating officer, remains missing. “Marsalek and other Wirecard executives are accused of booking phony revenues of at least $2 billion. German prosecutors allege that the payment-processing company used the fake revenue to borrow at least $3 billion. Most of the company’s cash has disappeared, investigators said.” Source: https://fcpablog.com/2020/08/13/germany-triggers-international-manhunt-for-missing-wirecard-executive/

Why do these sound so familiar?

You might have heard of Theranos. It’s now an HBO documentary - The Inventor: Out for Blood in Silicon Valley (2019) after being outed for “massive fraud.” Theranos hyped its pin-prick blood-testing device that could run hundreds of tests from just a finger-prick of blood rather than whole vials. But it couldn’t. According to Investopedia: March 14, 2018: The SEC charges Theranos, its founder and CEO Elizabeth Holmes, and its former President Ramesh "Sunny" Balwani with massive fraud. The complaint alleged that the company raised more than $700 million by deceiving investors for years about the company's performance.

You might have heard of Outcome Health, a Chicago-based startup that raised more than $600 million, for putting “tablet devices and screens in waiting and exam rooms” for displaying information and showing ads. That is until the Justice Department investigated them "to hold [this] healthcare technology company accountable for systematically committing fraudulent business practices for financial gain over many years,” said Inspector General Jay N. Lerner of the Federal Deposit Insurance Corporation’s Office of Inspector General (FDIC-OIG)."

https://www.justice.gov/opa/pr/outcome-health-agrees-pay-70-million-resolve-fraud-investigation

Outcome Health admitted to the fraud and settled with the Department of Justice and agreed to a fine of $70 million. “Outcome employees at the time falsified affidavits and proofs of performance to make it appear the company was delivering advertising content to the number of screens in its clients’ contracts. Outcome executives and employees during that time also inflated patient engagement metrics regarding how frequently patients engaged with Outcome’s devices. Furthermore, an executive at the time altered a number of studies presented to clients to make it appear that the campaigns were more effective than they actually were, Outcome admitted."

"Outcome further admitted that its under-delivery on advertising campaigns resulted in a material overstatement of its revenue for the years 2015 and 2016. The company’s outside auditor signed off on the 2015 and 2016 revenue numbers because executives and employees at the time fabricated data to conceal the under-deliveries from the auditor."

In September 2019, the SEC Charges Comscore Inc. and its former CEO, Serge Matta, with Accounting and Disclosure Fraud, stating "Comscore, at the direction of its former CEO Serge Matta, entered into non-monetary transactions for the purpose of improperly increasing its reported revenue. This scheme enabled Comscore to artificially exceed its analysts' consensus revenue target in seven consecutive quarters and create the illusion of smooth and steady growth in Comscore's business."

When Ad Tech Vendors (T/S)ell You Stuff

Valuable, and difficult, lessons for those who suffered losses from the above scams. To protect yourself from large scale ad tech scams that directly mirror the above, be sure to listen, very very carefully to the words the ad tech scammers use when s/telling you their products and services.

For example, you bought “traffic” from them; and they sold you “traffic.” They never said the traffic came from real humans visiting webpages or using mobile apps. You never asked what “traffic” meant, actually (and you never specified in your legal agreements with them). They may have even sold you “valid traffic.” They never said that was from humans either. It was traffic that was marked “valid” by fraud detection technology vendors because they couldn’t detect that it was not valid or not human.

For example, you paid extra for programmatic targeting parameters like gender, age, demographics, psychographics, what they liked, etc. Ad tech data sellers sold you all those targeting parameters; you never asked if the parameters were accurate, how the data was collected, and if or how they verified the accuracy. Turns out, the data is very INaccurate. And you never included a clause in your legal contacts with them about auditing or checking those data sets and parameters for accuracy.

For example, You paid the agency for a media plan that planned for 100 million ad impressions to be purchased and displayed. But only 60 million impressions were actually available and purchased during the campaign. They never said 100 million impressions would actually run; and you never asked if 100 million impressions DID run. And you never asked what happened to the unspent media dollars or where those dollars went. You also never asked the agency where they sourced that low cost inventory for you, what they paid for it, what they charged you for it, etc. Oh, and you never asked for the unspent money back.

If their rebuttals include: 1) you bought traffic; we never said it was human, 2) you paid extra for targeting; we never represented its accuracy, and 3) we hoped to buy 100 million impressions; you never asked what happens if we didn’t actually buy all that, you know you’ve been scammed. Listen for the specific words they use. Think of scenarios, what you didn’t ask and what you may have missed. And be sure that you have the legal recourse to ask for, and insist on, audits of analytics, log files, and money trail. Otherwise, your agencies and adtech vendors can just lie to you in your face, and you wouldn’t be able to do anything about it. See these examples of (nearly) total fraud that have been documented by myself and others, over the years:

.