Savings App Chip Raises £10.7 Million in 48 Hours as Part of Future Fund Round on Crowdcube

by JD AloisSavings App Chip is says it raised £10.7 million in under 48 hours as part of a Future Fund round hosted on Crowdcube. A total of £2 million was raised in under 10 minutes and £4 million in under an hour.

The Future Fund is a COVID support scheme that seeks to help early-stage firms by providing matching funds for an investment round from the UK government. A convertible security is sold to investors with the expectation it will turn into equity at a future date.

The funding is said to be part of the Fintech’s Series A round. Chip said that around 25,000 individual investors pre-registered ahead of the offering. In the end, 6420 investors participated in what is said to be the largest convertible offering in UK crowdfunding history as well as the largest Future Fund round.

Simon Rabin, Chip’s Chief Executive Officer, said their Future Fund round “means big things for Chip.”

“The growth we’ve seen this year has been incredible, but it’s time to take the business to the next level. Right now we are presented with a huge opportunity to capture a slice of Europe’s €30 trillion savings market that’s ripe for disruption, and Chip is poised ready to accelerate and dominate this space as a market-defining savings and wealth management app.”

Rabin said the only downside was that strong demand in the offering meant that they ran out of allocation before the entire 25,000 pre-registered investors were able to participate:

“We want to give as many people as possible the opportunity to own a part of Chip and are therefore working on finding a way to allow for more capacity, so make sure you watch this space.”

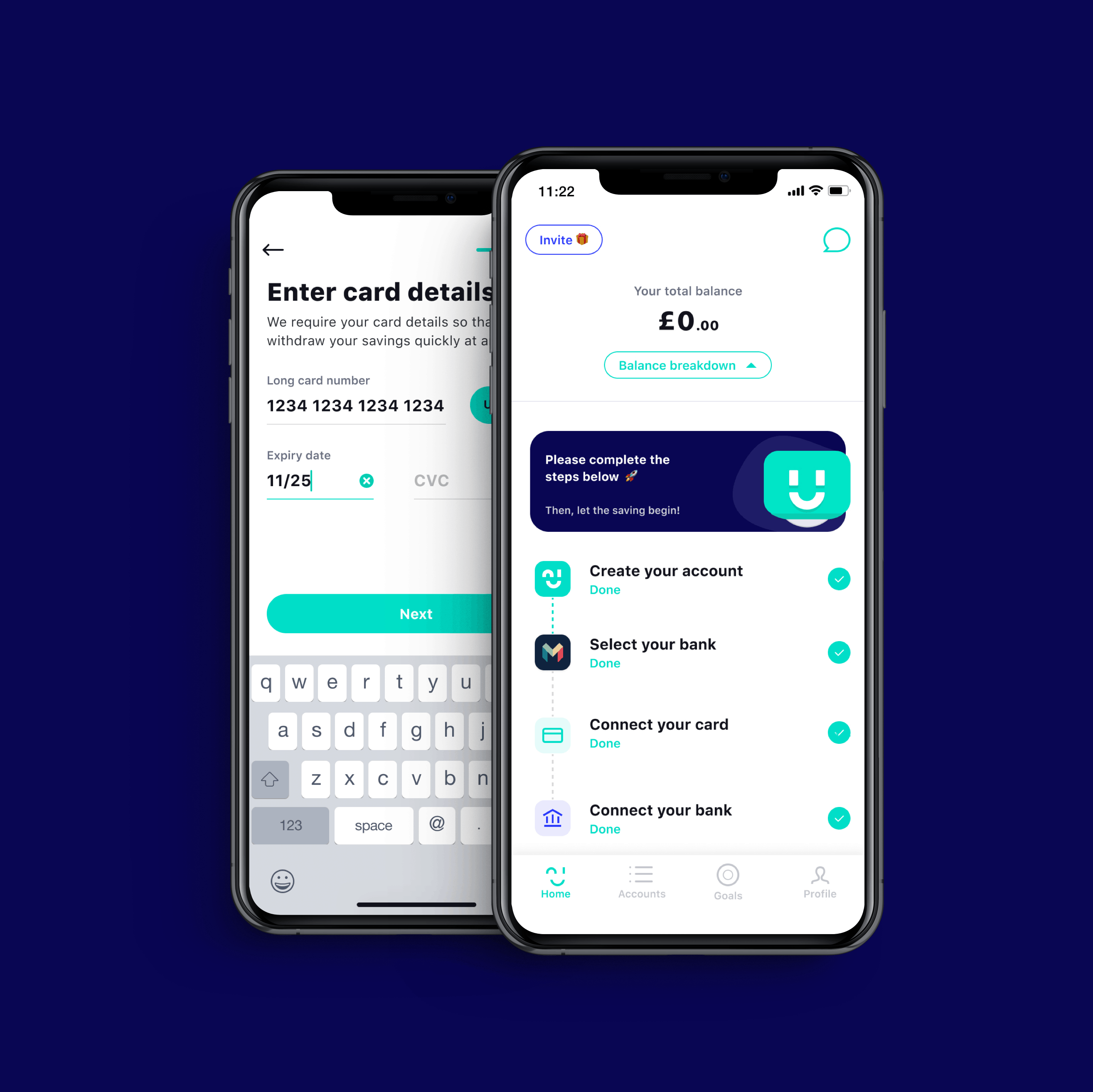

Chip notes that 2020 has been a good year for the company. According to the firm, Chip has grown to approximately 280,000 users having processed £165 million in savings. Chip is fully authorised by the UK Financial Conduct Authority and includes FSCS eligible savings accounts.

Chip says this investment will be used to fuel Chip’s growth while discussing future investments from VCs.

The funding is anticipated to enable Chip to improve its infrastructure and capacity to give access to more deposits, launch their premium account, ChipX, and evolve to investment funds, ISAs, and LISAs and, ultimately, pensions.

Chip most recently raised £2.6 million from 4000 individual investors in a securities offering this past April.