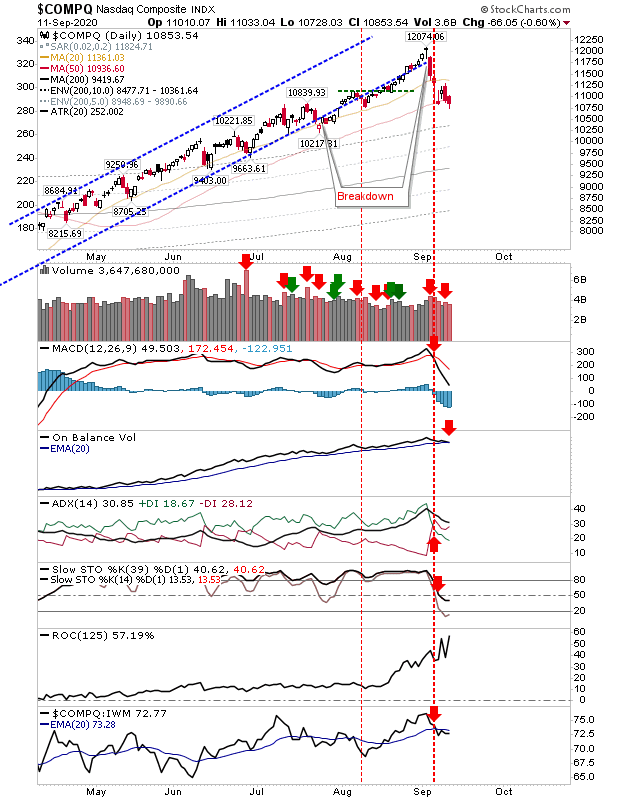

Indices Close Lower With Swing Lows Under Pressure

The NASDAQ closed below its 50-day MA on Friday, as the early week swing low finds itself vulnerable to an undercut and loss of support. Expectation would be for a measured move down, which, given the 1,000+ point move from the 12,074 high to the swing low, would set a current target around 10,250. Technicals are net bearish with the index underperforming relative to the Russell 2000.

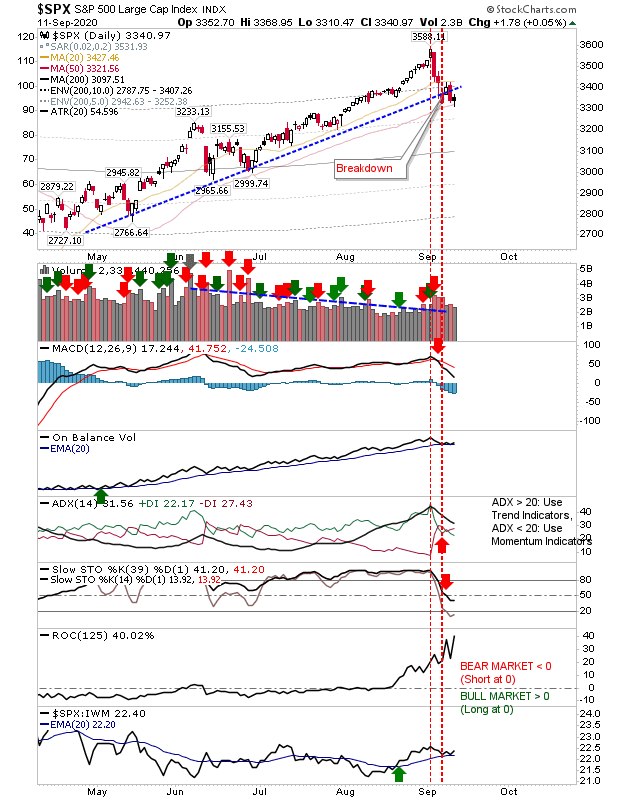

The S&P failed to recover the rising trend, so no 'bear trap' but there is still an opportunity for bulls to defend its 50-day MA. It has the benefit of a relative outperformance against the Russell 2000 to fuel a recovery.

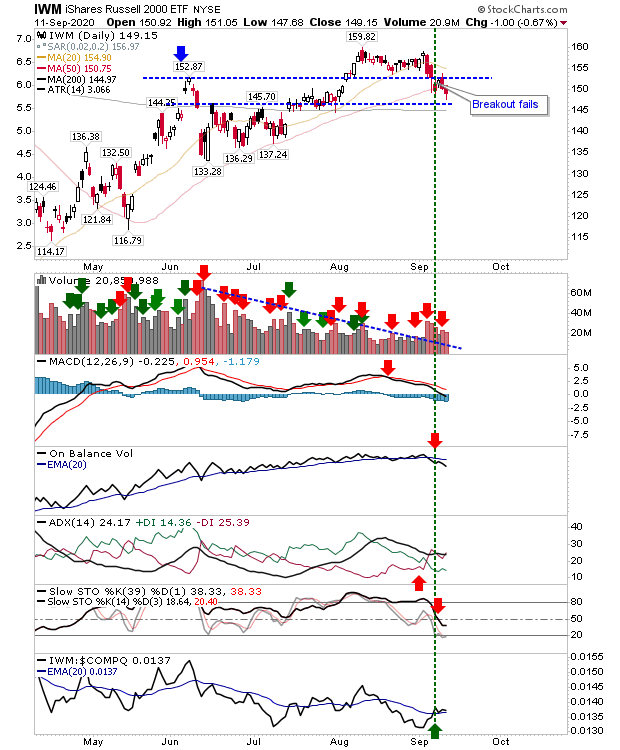

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) had already lost consolidation support of $152.50, then the bounce failed to recover this loss. Technicals are net negative with the 200-day MA the last stand for the index. What happens here will have repercussions for other indices.

For the coming week, bears will try to press their advantage and send markets below their recent swing lows in what could morph into measured moves down. The 200-day MA test will be key for the Russell 2000 as it will set the the tone for what may happen in the S&P and NASDAQ in the coming days.