Wall Street Gets Excited About Coronavirus Vaccines Again

by Kenneth Rapoza

When it doubt about the short term direction of the stock market, wait for solid news about Sars-Cov-2 vaccines and — presto.

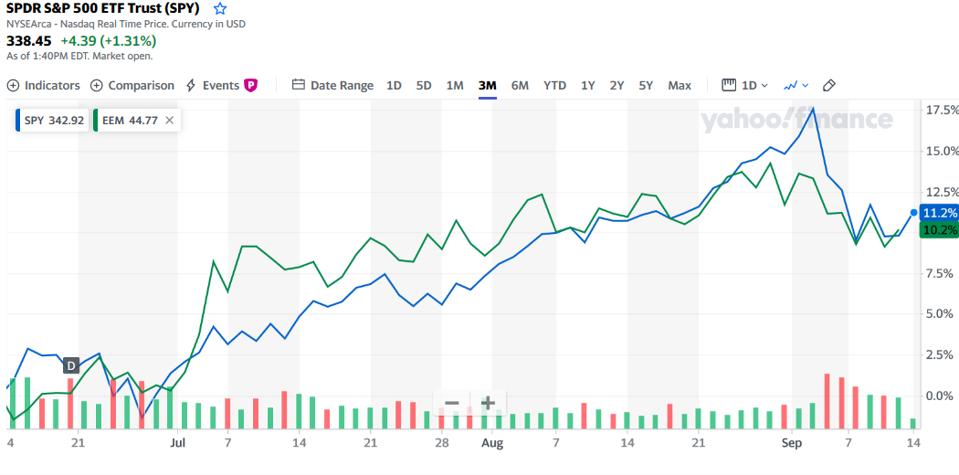

The S&P 500 is up over 1.5% on Monday afternoon, with riskier emerging markets up 1.4%.

Last week, the market declined on news that the Covid-19 vaccine being produced by AstraZeneca made at least one person seriously ill. The trail was put on temporary hold. AstraZeneca's CEO, Pascal Soriot, said he still has hopes that the trial process will resume soon, and reminded everyone that it is not unusual to see averse reactions to drugs in their trial phase.

The U.S. government’s Operation Warp Speed has put many non-SARs related drugs on the backburner in order to give the Food and Drug Administration more time to examine trials of new vaccines hoping to put a lid on this easily spread pathogen.

Under normal circumstances, it can take years before a vaccine is allowed into the market by the FDA.

“This is the reason that regulators have given the green light to AstraZeneca, and the company announced over the weekend that its trail process is back on track,” says Naeem Aslam, chief market strategist at AvaTrade in London. “Investors have become more optimistic, and they are ready to push the markets higher.”

Russia Vaccine Making Progress

Over the last two weeks of September, some 55,000 volunteers have been recruited in Moscow to take the Russian Sars-2 vaccine. That’s more than 40,000 people required by their regulators in phase three clinical trials.

The Russians are using a “human adenoviral vectors” platform which has been tested by scientists in countries other than Russia.

The Lancet published a review of the Russian drug, nicknamed Sputnik V, and said that in two open, non-randomized phase studies at two hospitals in Russia of men and women between the ages of 18–60 years old, all participants produced antibodies to the Sars-Cov-2 glycoprotein. The report authors and researchers said “the vaccine is safe, well tolerated, and induces strong humoral and cellular immune responses in 100% of healthy participants. All reported adverse events were mostly mild.”

Russia is trying to be the first to market with a vaccine.

Others include Pfizer , Moderna, Johnson & Johnson and CanSino Biologics, a Canadian-Chinese joint venture biopharmaceutical firm whose vaccine for Covid-19 has been approved for the Chinese military.

The speed at which these vaccines are being rolled out worries many about its safety long term.

Pfizer and Moderna are using a relatively new biopharmaceutical technology for its drugs and are still recruiting for phase 3 clinical trials.

AstraZeneca plans to recruit 30,000 U.S. volunteers within the next few months.

Risk On? Risk Off?

Investors are still expecting some serious financial fall out from the pandemic. There is a lot of dust under the rug right now, but someone is going to lift it in their respective countries, or industries; and then others will, too.

The ongoing pandemic is too big a financial setback not to expect some form of debt woes in poorer countries, in particular.

Some countries may just deal with shorter term liquidity crises, but others will likely see solvency issues either at the local level, or within some sectors of their economies — think travel and tourism in Brazil, for example.

“Time is of the essence to find solutions to mitigate the damage,” says Alicia Garcia Herrero, a top Asia-Pacific economist for Natixis in Hong Kong.

Fed liquidity may look ample today for emerging markets soaking up American portfolio money, but it can quickly dry up if there is a new episode of global dollar shortages like there was in March.

The New York Fed released a consumer expectations survey today and it was relatively flat with 18% of respondents in the month of August saying they feel like they can lose their jobs, up from 16% in July.

Lockdowns have crushed economies globally, not just here in the U.S. where restrictions on the services sector remain in important states like New York and California.

China only looks resilient because it has long been the world’s global manufacturing hub.

Still, BlackRock said today that they are staying “moderately pro-risk”.

The V-shape recovery story is in tact. BlackRock isn’t seeing much evidence of permanent damage to the economy, even though many companies and individuals are going through a painful period of wages lost, and bankrupt businesses — especially on the services side, once again.

U.S. bankruptcy filings rose through July but have fallen in August.

But, the market knows that some U.S. firms use bankruptcy proceedings simply to protect themselves from creditors to catch a breather as the pandemic continues.

The recent U.S. stock market selloff may be triggered by the unwinding of crowded positions in tech – this year’s best performing sector. It also highlights some fundamental risks investors need to navigate in coming months, such as the increasing dominance of tech stocks in the market. Stimulus exhaustion is also a risk, BlackRock analysts led by Elga Bartsch, head of macro research for the BlackRock Investment Institute, wrote in a note to clients on Monday.

A premature retrenchment of stimulus could hamper economic activity.

Once again, is there any big Wall Street trading firm that hates government propping up securities markets?

Count them on one hand.

Treasury Secretary Steve Mnuchin said today that he was willing to go back to the drawing board on phase four stimulus, with no restrictions on what is up for discussion.

The election in November also promises to confuse investors, with the potential for drastically different implications on policy and markets.

The bottom line for Bartsch and BlackRock: stay moderately pro-risk over the next six to 12 months.