7 Gun Stocks to Buy During the Coronavirus Pandemic

Self defense is a bipartisan issue

Editor’s note: “7 Gun Stocks to Buy During the Coronavirus Pandemic” was previously published in July 2020. It has since been updated to include the most relevant information available.

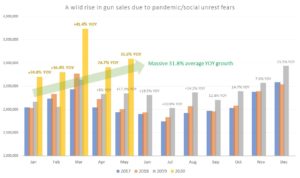

A largely ignored market segment, gun stocks have soared in both interest and demand. With fear, chaos and overall uncertainty about the future representing the dark side of the new normal, people have gravitated toward firearms, mainly for self-defense reasons. However, this nationwide surge in gun sales is unlike anything we’ve ever seen.

According to the FBI’s database, gun dealers submitted over three million firearm background checks in May. This generally corresponds to the total number of guns sold in the month, although keep in mind that federal law does not require private sellers to initiate such checks. Even so, retail sales of firearms from January through May is staggering at over 15.2 million units.

To put this figure into perspective, in all of 2009, Americans bought just over 14 million firearms. And that was when former President Barack Obama took over the White House. Thus, the case for gun stocks to buy is very much a bankable phenomenon.

Source: Chart by Josh Enomoto

In my view, this record-breaking firearm demand can be broken down into four waves. First, Asian Americans fearful of racist scapegoating began stockpiling guns en masse. This contributed to an unbelievable 3.74 million guns sold in March.

Second, economic fears as the job market collapsed drove sentiment toward gun stocks. It’s not unreasonable to believe that lack of viable opportunities causes crimes of desperation. Third, the present social unrest, especially calls for defunding the police – or in some cases, abolishing law enforcement altogether – have created extreme fear among ordinary citizens.

And the fourth wave? Possible political changes, which will further incentivize these seven gun stocks to buy:

- Smith & Wesson Brands (NASDAQ:SWBI)

- Sturm Ruger (NYSE:RGR)

- Vista Outdoor (NYSE:VSTO)

- Olin Corporation (NYSE:OLN)

- Sportsman’s Warehouse (NASDAQ:SPWH)

- Axon Enterprise (NASDAQ:AAXN)

- Big 5 Sporting Goods (NASDAQ:BGFV)

From a purely observational standpoint, I find it difficult to believe that President Donald Trump will win reelection. Although polls at this stage of the game should be taken with a huge grain of salt, they indicate the tremendous discontent that Americans have toward the administration. Thus, another wave, a blue one, could come crashing down in November.

And you know what conservatives say about Democrats – they’re here to take your guns! Before they do, here are seven gun stocks to buy.

Best Gun Stocks: Smith & Wesson Brands (SWBI)

Source: charnsitr/Shutterstock.com

Formerly known as American Outdoor Brands Corporation, Smith & Wesson Brands finally got its identity back. As part of a previously announced spinoff, American Outdoor will focus on its namesake outdoor sports industry. On the other hand, Smith & Wesson can only ply its trade as one of this country’s favorite firearms manufacturers.

From the get-go, this is one of those gun stocks that has an air of notoriety about it. Given the progressive nature of modern America, Smith & Wesson admittedly is a bit of relic. You’re probably not going to find too many of its employees sipping soy lattes.

Beyond that, American Outdoor is an organization that has fundamentally thrived during the coronavirus pandemic. Although I’ve been very critical about President Trump’s handling of this crisis, I will give the Commander-in-Chief credit for declaring gun shops essential.

Since law enforcement are already under tremendous stress, the ability for law-abiding citizens to protect themselves became even more crucial, thereby bolstering gun stocks.

Another factor bolstering AOBC stock is the underlying product portfolio. The company has comprehensive solutions for all your home-defense needs, ranging from subcompact pistols to the much-maligned, but very effective AR-15 rifle.

Since you asked, my personal favorite is the Model S&W500. As the most powerful production revolver in the world, it truly packs a wallop. Firing one of these is like unleashing Satan from the gates of perdition. You don’t even have to use it for it to be an effective self-defense tool. No one is going to mess with you if you’re carrying this beast.

Sturm Ruger (RGR)

Source: Shutterstock

Like other gun stocks, Sturm Ruger found itself behind the eight-ball in the early stages of the pandemic. For most folks, their priorities are securing food, water, and essentials.

Invariably, though, if the crisis worsened, a household would have to protect themselves and their vital supplies. Therefore, RGR stock soon found incredible momentum.

Further, I don’t think this momentum will die down anytime soon. Sure, like anything, you don’t expect gun stocks to perpetually move higher. But with nationwide protests sometimes spilling over into open conflict, along with the specter of a Democratic takeover, RGR has frankly never looked better.

As I mentioned near the top, much of the firearms sales have to do with specific communities wishing to protect themselves. However, another catalyst is the economy. Should it continue to worsen for Main Street, prospective gun buyers see every incentive to secure their purchase. With more than 44 million Americans filing for unemployment benefits since the pandemic started, you must assume that desperation will rise.

When that happens, violence is inevitable. As I said, the case for RGR stock has arguably never been stronger.

Additionally, Ruger has a reputation for rugged, reliable firearms. For first timers, this is a solid brand to consider, likely inspiring a surge in sales.

Vista Outdoor (VSTO)

Source: Shutterstock

Pure-play gun stocks have always been a rare breed. With Vista Outdoor selling its Savage Arms and Stevens firearms brand in the summer of 2019, this distinction became rarer. Unfortunately, the timing was terrible. Again, with desperate customers – many of them first-time buyers who don’t know any better – any firearm is a good firearm.

Still, I wouldn’t dismiss VSTO stock outright. Despite the poor timing – and really, who could have guessed that we would suffer a paradigm-shattering pandemic – Vista Outdoor still owns its ammunition brands.

If you think about it, this business is equally as important. After all, if intimidation fails to stop an intruder, you want something to back up your warnings.

You know what? Usually, gun owners think well ahead of time. Thus, during the start of the crisis, possibly millions of firearm advocates made a run for ammunition, leading to shortages. Although this situation initially calmed down, the recent spike of social unrest has again catalyzed panic-buying.

As well, we could have a second wave of coronavirus, leading to another run on firearms and ammo. Thus, while VSTO stock isn’t among investors’ first choice for gun stocks, it could still be incredibly relevant.

Olin Corporation (OLN)

Source: IgorGolovniov / Shutterstock.com

As a global manufacturer and distributor of chemical products, let’s just say that Olin Corporation doesn’t exactly rank highly on the sexiness chart.

However, an unparalleled explosion in firearms sales may change this narrative. In addition to chlor alkali products and epoxy technology, OLN stock is levered to the ammunition industry, thanks to Olin’s Winchester brand.

Typically, if you visit your local gun range, you’ll more than likely end up shooting “practice” rounds. Comparatively, these are rounds that are designed for high-volume usage, what shooters call “plinking.”

While Winchester offers products for such purposes, the company specializes in purpose-built ammo. As you might guess, these are much more expensive than your plinking ammo.

However, due to the extreme demand for self-defense, no one cares about price. Instead, people just want to purchase whatever ammo they can get their hands on. As the Washington Examiner reported, shortages have hit both firearms and ammunition in certain parts of the country. While that stinks for consumers, it’s a big plus for OLN stock.

Currently, shares have come down from their April peaks. However, for the speculator, Olin could still represent good value among gun stocks. Again, should a second wave hit, the company is well-positioned. Also, with the base of gun owners having increased conspicuously, these newbies will need to train. Therefore, Olin has a credible long-term narrative.

Sportsman’s Warehouse (SPWH)

Source: OpturaDesign/Shutterstock.com

For newcomers to the firearms industry, I imagine that visiting a gun store for the first time is much like visiting a gentlemen’s club. On one hand, you’re fascinated with this industry, if only for its “bad boy” image. On the other hand, you can’t help but feel a little icky.

Fortunately, we have retailers like Sportsman’s Warehouse. To me, I find that it’s just like shopping at any big-box retailer. The exception, of course, is that you’re shopping for AR-15s and not, say, 10 gallons of mayonnaise. Personally, I find this familiarity will help ease uncomfortable first-timers, which bolsters the case for SPWH stock.

Beyond that, Sportsman’s Warehouse stores typically have very large footprints. With lines out the door during the early stages of the pandemic, it has been difficult for firearms retailers to maintain social distancing. And that’s still the case even months removed from the worst of the health crisis. But with Sportsman’s, this task is a little easier, improving the narrative for SPWH stock.

Finally, I don’t think it’s any surprise that shares launched into orbit over the past two months. Fear is a powerful motivator, making gun stocks the toast of Wall Street, whether it wants to admit it or not.

However, you may want to let SPWH stock cool down a little bit as it’s technically overheated.

Axon Enterprise (AAXN)

Source: Shutterstock

No matter the circumstance, buying a firearm is a big deal. For some people, their personal conviction may prevent them from making the leap. I totally understand.

While the Second Amendment protects Americans’ rights to keep and bear arms, no one is obligated to exercise that right. But for those who still seek personal protection, Axon Enterprise represents a viable solution.

True, AAXN stock is not what you would consider a pure-play example among gun stocks. Heck, it’s not even a firearms manufacturer. Instead, Axon develops Tasers, which fire non-lethal projectiles at assailants, temporarily debilitating them via electric shocks. Once on the floor incapacitated, the user can call law enforcement. It’s a cleaner process, both figuratively and literally.

Another factor that may support the bull case for AAXN stock is the reality of home defense. In these circumstances, an assailant is physically near you, which means long-range rifles are overkill and likely less effective. But with a Taser, you just point and shoot. Plus, you have the confidence that you’re not going to accidentally kill your neighbor.

Finally, Axon’s body cameras for law enforcement officers have become incredibly relevant. Due to the heightened social environment, it’s become more critical to understand how police interact with communities of color. Axon provides a “real-life” view of these interactions, potentially lending toward protocol improvements and more effective training.

Big 5 Sporting Goods (BGFV)

Source: Jonathan Weiss / Shutterstock.com

Out of the gun stocks on this list, Big 5 Sporting Goods is easily the riskiest. Part of it has to do with the fact that it’s not a direct play on the firearms industry. Primarily, the company is exactly what it says it is: a retailer of sporting goods.

As you can imagine, this product category hasn’t exactly been popular in the digitalization age. Moreover, this segment has witnessed many bankruptcies over the years. Honestly, BGFV stock is one of those names that is liable to imploding.

However, it may get a lifeline because of Dick’s Sporting Goods (NYSE:DKS). In response to the Parkland shooting, the company began eliminating firearms from their inventory, even going so far as destroying $5 million worth of military-style rifles. Dick’s CEO Edward W. Stack justified the move as saving lives.

Under that logic, manufacturers of airplanes, automobiles, kitchen knives and whatever else can kill humans should cease production immediately.

But because of Dick’s reactionary tactics, Big 5 can differentiate itself by advertising its firearms and ammunition business. Should more troubles arise from the coronavirus or social unrest, BGFV stock could swing higher.

Usually, gun owners aren’t even thinking about Big 5 for their firearms needs. Go to their “sporting” rack and you’ll just find an assortment of shotguns and bolt-action hunting rifles. But when the smelly stuff hits the fan, any gun is better than none at all.

Just be sure not to get too heavily involved with BGFV stock.

A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global 500 companies. Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. As of this writing, he did not hold a position in any of the aforementioned securities.