Govt seeks Parliament’s approval for Rs 2.35 lakh crore of additional gross expenditure

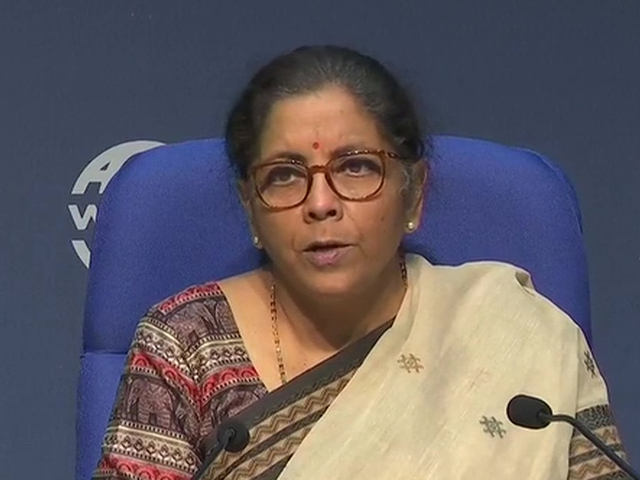

Finance Minister Nirmala Sitharaman on Monday sought the Parliament nod for additional spending of Rs 2,35,852.87 crore, including Rs 40,000 crore towards enhanced expenditure under Mahatma Gandhi National Rural Employment Guarantee Program.

by Gaurav Noronha

NEW DELHI: The government has sought Parliament’s approval for Rs 2.36 lakh crore of additional gross expenditure of which Rs 1.67 lakh crore would be net cash outgo after accounting for Rs 68,868 crore of savings or reallocation from ministries with under-utilised funds.

The Supplementary Demand for Grants 2020-21, introduced in the House on Monday, included Rs 40,000 crore for enhanced expenditure under Mahatma Gandhi National Rural Employment Guarantee Program, as announced in the Atmanirbhar Bharat package.

This would take the total funds deployed under the rural employment scheme to Rs 1 lakh crore this fiscal.

The Centre was trying to boost rural employment as most migrant labourers remain in the hinterland after having reverse-migrated owing to the pandemic and ensuing lockdown.

The largest chunk of the additional spending of Rs 46,602 crore was allocated as grants to states.

This consisted of Rs 44,340 crore as Post Devolution Revenue Deficit Grant and Rs 2,262 towards the States Disaster Response Fund, as per the accepted recommendations of the 15th Finance Commission.

Apart from these, the government listed Rs 33,771 crore as direct benefit transfers of which Rs 30,957 crore is earmarked for Jan Dhan Yojna women accounts holders and Rs 2,815 crore for the Indira Gandhi National Old Age Pension scheme.

Bank recapitalisation

The government also sought the legislature’s nod for Rs 20,000 crore towards ‘recapitalisation of Public Sector Banks through issue of Government Securities’.

Banks are likely to be in need of additional capital as their provisioning requirements will increase on account of pandemic-induced stressed loan accounts.

In July, Reserve Bank of India (RBI) Governor Shaktikanta Das said that bank recapitalisation was necessary and asked lenders to raise money in advance to build resilience in the financial system.

According to the RBI’s financial stability report, the gross non-performing asset ratio of public banks will increase to 15.2 % by March next year from 11.3% a year ago.

The amount in the list of demands will not count towards the additional net outgo.

However, this will be lower than earlier instances of government capital infusion into banks. In 2017-18 it had infused Rs 80,000 crore and Rs 1.06 lakh crore in the next fiscal.

Further, the government sought Rs 4,000 crore ‘for meeting additional expenditure’ as grants for the National Credit Guarantee Trustee Company to provide sovereign guarantee under the Emergency Credit Line Guarantee scheme for micro, small and medium enterprises.