Five Below Stock Looks Attractive At $128

by Trefis Team

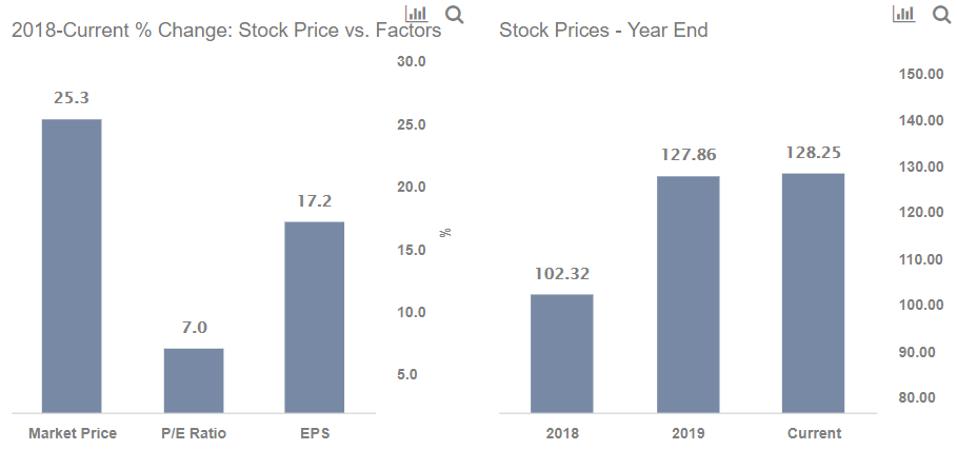

Despite a spectacular 140% rise since the March lows of this year, at the current price of around $128 per share, we believe Five Below’s stock (NASDAQ: FIVE), a teen-focused discount retail company, still looks attractive and it could offer more upside from the current levels. Five Below’s business lives up to its name by offering a wide range of goods priced at $5 or less. The stock price is almost 23% higher from the levels seen in early 2018. Our dashboard, ‘What Factors Drove 25% Change in Five Below Stock between 2018 and now?‘, explains more with underlying numbers.

Five Below’s stock price grew by roughly 25% between the 2018-2019 period, driven by the retailer’s revenue growth of 18%. In addition, the company’s earnings per share grew by 17% during this period. However, Five Below’s net income margin contracted slightly from 9.6% in 2018 to 9.5% in 2019, as it continued to expand its ecosystem with store openings and investments. The company’s P/E multiple changed from 38x in 2018 to 41x in 2019. Further, the company’s sales have held up well during the pandemic and are positioning themselves for long-term digital sales growth, as a result of which Five Below’s stock is almost flat year-t0-date. Consequently, the multiple currently stands at 2019 levels now, but we expect it to grow going forward on the back of the company’s store growth strategy. The current multiple appears attractive when compared to its historical levels, and the stock could offer more gains for investors willing to invest for the long-term.

So what’s the likely trigger and timing for further upside?

Five Below wasn’t fully operational for much of the fiscal second quarter (ended Aug 1), and traffic trends remained weak. Despite this, the youth-focused retailer posted a modest 2% year-over-year (y-o-y) revenue growth to $426 million. However, comparable sales decreased by 12%, driven by a reduction of approximately 19% in comp-store operating days. With a lower marketing and store expense, Five Below was able to improve its earnings to $0.53 a share compared to $0.51 a share in the year-ago period. E-commerce sales were strong in Q2 with sales over four times higher than last year’s second quarter, yet they still represented only a low single-digit percentage of its total sales. But the company is looking to grow further in e-commerce with the help of its Hollar.com (an online dollar store) acquisition.

Five Below did not let the pandemic get in the way of its store expansion. The company opened 63 new stores in the quarter, while also undertaking the reopening of the locations it was forced to close due to the pandemic. Most of the new locations will include a section of items priced above $5 called Five Beyond, self-checkout capabilities, and an expanded snack area, to drive further traffic. The retailer is expecting to remodel approximately 45 stores and also looking at a 12% to 13% unit growth in stores by the end of the year (with a total of 1010 to 1020 stores). It should be noted that Five Below ended Q2 in a strong liquidity position with $202 million in cash, cash equivalents, and investments and no debt.

Five Below continues to thrive during difficult times and is looking forward to the upcoming holiday season to also lift its sales.

What if you’re looking for a more balanced portfolio instead? Here’s a top-quality portfolio to outperform the market, with over 100% return since 2016, versus 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk. It has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams