Choosing the right tax structure

For investors who are still undecided on which tax structure to go with in FY 2020-21, here's some help

by Aakar Rastogi

It's been several months since the financial year 2020-21 began, but many are still undecided on the big question - whether to continue with the old tax structure or opt for the new one? The new tax structure has lower rates but requires you to forego all deductions and exemptions, such as those under Sections 80C and 80D.

Fortunately, the salaried can change their tax structures later. If you opt for the new tax structure but later realise that the old tax structure was better, you can switch to it. This can be done even within the same financial year. However, businesspersons can select their tax structure just once.

Which tax structure is better for you depends on the deductions and exemptions you avail under the old tax structure. These include the standard deduction of Rs 50,000, your Employees' Provident Fund (EPF) contribution, house-rent allowance (HRA), interest paid on home loan, health-insurance premium, etc.

For instance, let's consider someone earning Rs 10 lakh/year. His EPF deductions (tax-exempt under Section 80C) are Rs 50,000 per year and he pays health insurance premiums (tax-exempt under Section 80D) of Rs 10,000. Given these and the standard deduction of Rs 50,000, his tax in the old system will be Rs 94,120. In the new system, where there are no deductions and exemptions, it would be Rs 78,000. Hence, his tax outgo would be less in the new system. But if he avails the full 80C deduction of Rs 1.5 lakh, invests Rs 50,000 in the NPS under Section 80CCD(1B) and pays health insurance premiums of Rs 10,000, he will have to pay a tax of Rs 62,920. This tax is lower than that in the new system.

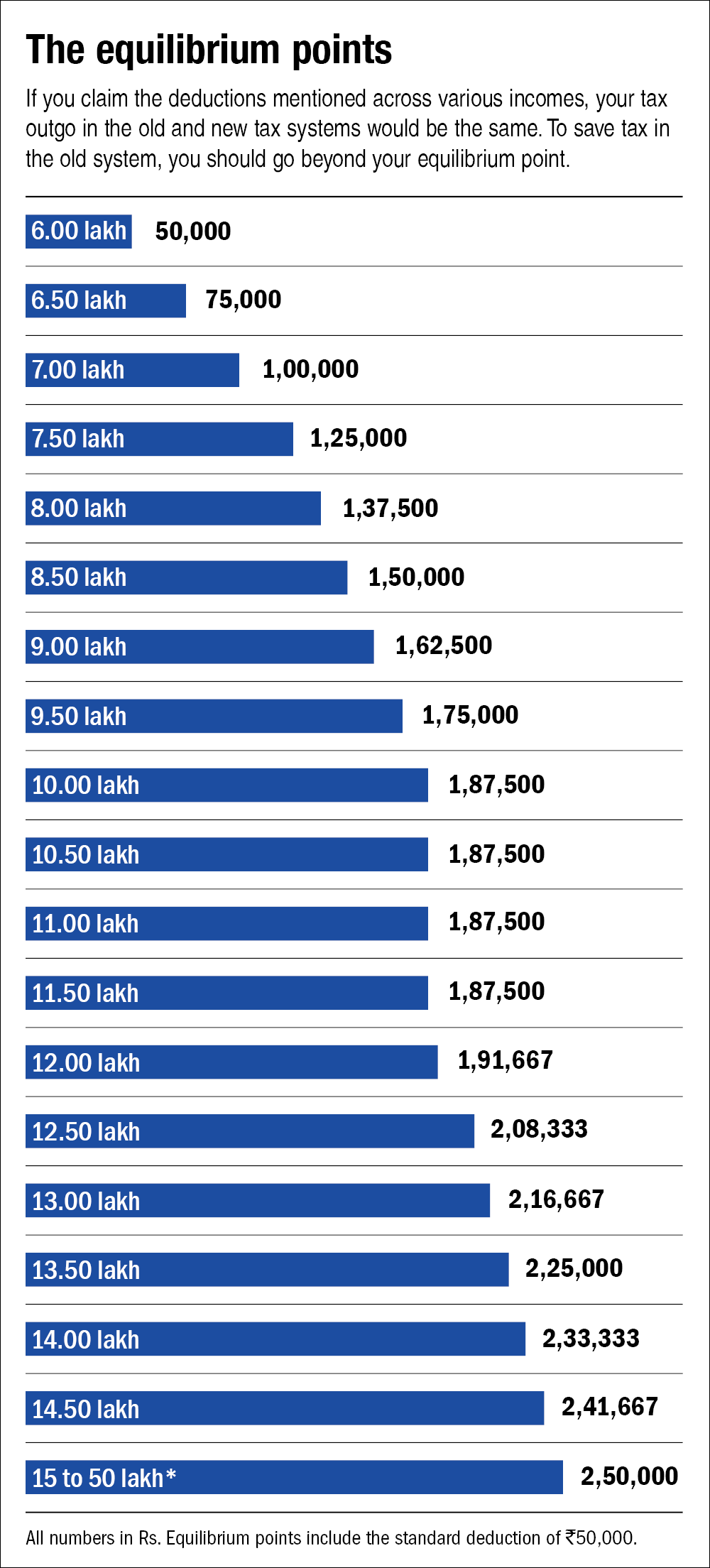

We have worked out equilibrium points for various income groups. These represent the amount of deduction that brings the old and new tax structure at par in terms of the tax payable. Any further deductions from these equilibrium points will make the old system beneficial as your tax outgo would reduce. If your tax-admissible expenses and investments (not just 80C and 80D ones but also your HRA, donations under Section 80G, etc.) are more than the given equilibrium level, you can stay with the old tax structure. Otherwise, the new one's for you.