Will Lockheed Martin Continue To Outperform Textron?

by Trefis Team

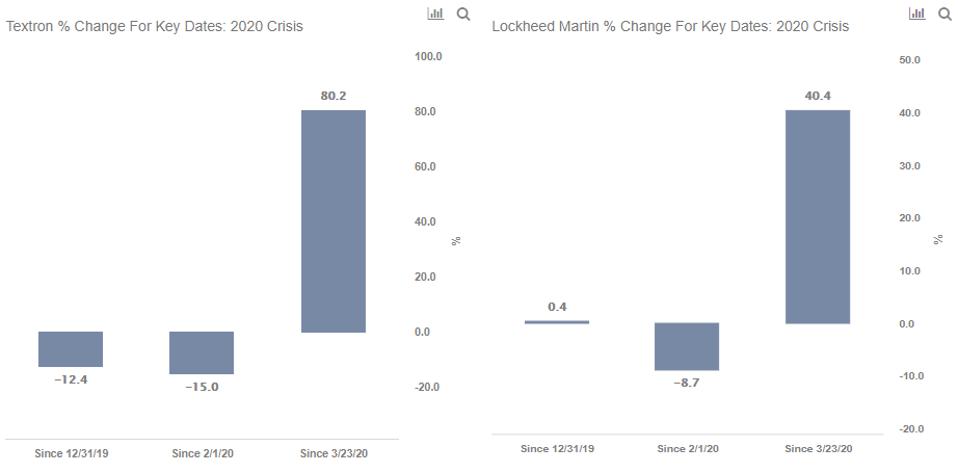

Textron stock (NYSE: TXT) has declined by close to 15% since early February after the WHO declared the Coronavirus a global health emergency, while Lockheed Martin stock (NYSE: LMT) has fared slightly better and lost only 9% of its value. While travel restrictions across the world are negatively affecting multiple sectors of the global economy, the long-term defense procurement contracts by the U.S. government has supported military suppliers and contractors. In 2019, the U.S. government contributed nearly 71% and 24% of Lockheed Martin and Textron’s total revenues, respectively. Thus, Textron’s higher exposure to the commercial aviation industry has been a drag on its revenues and earnings during the pandemic. Therefore, Trefis expects Textron stock to continue to underperform Lockheed Martin in the near-term.

We compare trends in key metrics of Lockheed Martin and Textron over the years to determine their relative valuations under the current circumstances in an interactive dashboard analysis, Lockheed Martin Will Continue To Outperform Textron Supported By Stronger Order Backlog.

Why Has LMT Outperformed TXT Over Recent Months?

LMT’s P/E based on 2019 earnings has improved from 17.4x in 2019 to 17.5x currently, while TXT’s multiple has declined from 12.7x to about 11.1x. The steeper decline in Textron’s multiple can be attributed to its shrinking order backlog, declining demand for private jets, and the ongoing employee furloughs.

While Lockheed Martin’s multiple appears high compared to prior years, the company delivered robust earnings even during crisis. LMT’s second-quarter revenues increased by 12% and its order backlog surged by $7 billion to $150 billion. Whereas, Textron’s order backlog declined by $0.8 billion to $9 billion, primarily due to tepid demand for its Beechcraft and Cessna aircraft. As Textron’s Aviation segment contributes almost 40% of the total revenues, we expect the stock to continue facing headwinds in the near-term.

What if you’re looking for a more balanced portfolio instead? Here’s a top quality portfolio to outperform the market, with over 100% return since 2016, versus 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk. It has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams