Nvidia To Buy Arm – What’s Next?

by Kevin Krewell

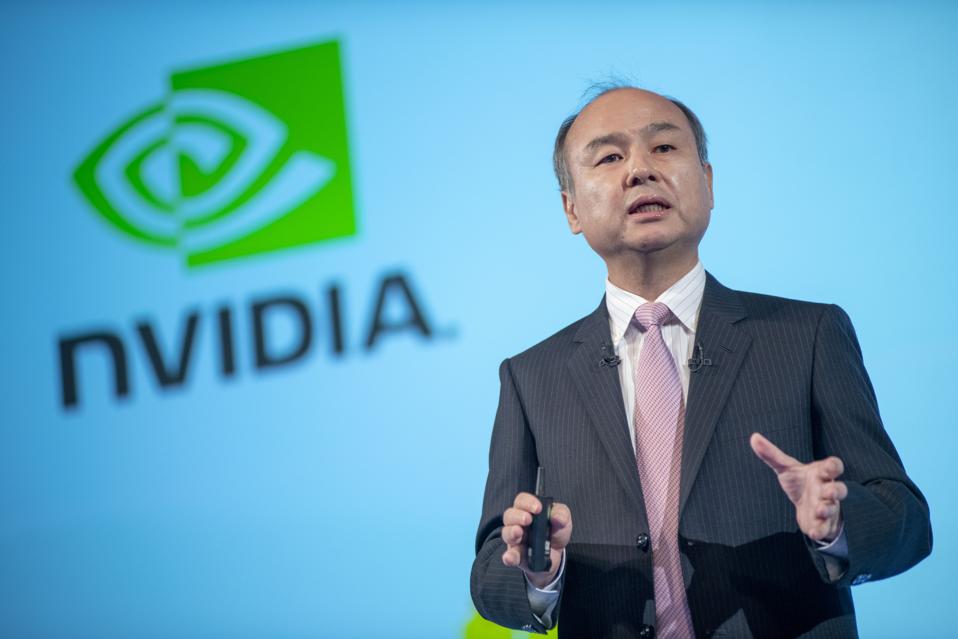

The rumors that Nvidia has been in talks with Softbank of Japan to buy the Arm intellectual property business has finally been confirmed. This is a coup for Nvidia and its CEO Jensen Huang as, if approved, it will give the company control of the most pervasive CPU architecture on the planet, far exceeding the volume of AMD and Intel CPUs shipped. The Arm architecture is pervasive – it is in just about every electronic device except most PCs, and cloud/data centers. This acquisition gives Nvidia a touchpoint across the entire silicon ecosystem. Nvidia will no longer be considered a niche GPU vendor. This is a big win for Nvidia and its CEO. For Arm, it puts the architecture into the hands of a company that values intellectual property and high-performance engineering. It also reunites two Arm executives (Rene Haas and Drew Henry) with their former boss at Nvidia. Nvidia considers the deal financially accretive and Arm has a strong business with good cash flow.

The Arm architecture is absolutely essential for every major category of communications and networking equipment from smartphones, to most smartwatches, many networking systems, set-top boxes, and most IoT devices.

Softbank originally bought the UK-based Arm in 2016 for $31B with the vision to drive intelligent devices to a trillion connected devices (often call the Internet of Things or IoT for short) by 2035. But SoftBank has had a number of missteps in its investment strategy and now Arm is on the block. Part of the reason may have been unrealistic optimism on the growth of the IoT, even though Arm has been setting records for shipments. While selling Arm to an investment group or spinning Arm back off in an IPO were options, Softbank shopped the company around to Arm licensees. It seems that Nvidia, buoyed by its strong stock price and cash flow, was the most interested in making a bid. Nvidia has just completed its largest acquisition with the data center networking company Mellanox. This latest acquisition gave Nvidia a taste for bold moves and acquiring Arm is the boldest move in the history of the company. The deal that Nvidia negotiated is to buy Arm for $40B in stock and cash.

One thing to consider is how the stock market will view the combination. The Arm business is engineering heavy but requires little capital investments. The architecture and core designs are licensed to companies that include a who’s who of the semiconductor and consumer electronics industries – Amazon, AMD, Apple, Intel, NXP, Qualcomm, Renesas, Samsung, ST Micro, and the list goes on and on. Chinese companies license the Arm IP through a Chinese joint venture where Arm owns a minority share.

Other consideration is that many of the Arm Licensees compete with Nvidia, which will be awkward and could be the source of some friction. At the press conference and in the press release, Nvidia insisted it will keep Arm’s open licensing model. If Nvidia treated Arm as an independent division much like Qualcomm’s QTL licensing division is separate from the QTC chip business, the company could keep a more hands-off approach to the licensing business deals. But during the press call, it seemed that Arm’s engineering teams would be merged with the Nvidia engineering groups. In some areas, Arm and Nvidia do overlap – Arm has its Mali GPU and Ethos machine learning accelerator, but the Arm cores are focused on low power while Nvidia is focused on performance – so we expect both to co-exist after the merger.

Certainly, Nvidia’s CEO seemed most interested in the high-performance side of Arm – the data center Neoverse CPUs and infusing it with more AI. Huang repeated that he wants to infuse the Arm architecture with more AI and focus on pervasive intelligent devices. There will probably be some concerns how Nvidia will invest in the Cortex-M microcontroller family, which is used by many embedded designs from companies such as NXP and Microchip. Nvidia did say it will continue to invest in Arm engineering teams and that includes all CPU cores.

The question of regulatory approval is also a big question. Nvidia’s acquisition of Mellanox took over a year to complete. Right now it is particularly difficult getting approval by China’s agencies. The acquisition of Arm has much greater impact across the industry and will likely get more scrutiny. But in Nvidia’s favor is that the two companies have different business models and don’t directly compete. The questions will mostly be whether Nvidia will be a good and fair steward of the Arm architecture and related IP. Arm architecture has a monopoly on the smartphone CPU IP business and a near monopoly in many other markets. Nvidia itself makes Arm-based processors for automotive, robotics, and streaming media businesses. The company will have to tread lightly when it competes with Arm licensees’ chips.

One company that will be particularly challenging for Nvidia to work with is Apple. The two companies have not had a working relationship in many years. Apple just this year announced it was moving its MacOS products to the Arm architecture, which will be part of Nvidia. That said, Apple and Nvidia don’t compete much in the market (Apple TV and Nvidia Shield are about it), and both companies’ interest in AI and high performance do coincide well.

This is just the beginning of a relatively long process and we’ll get to hear more on how the deal will affect the Arm ecosystem. This deal could be a bonanza for the open-source RISC-V International CPU architecture as companies may be concerned about the future of Arm and want a back up plan. This is especially true in the microcontroller market, where RISC-V has already gained traction.

There is no question this is a great deal for Nvidia and a huge win for CEO Jensen Huang. Nvidia would find itself at the center of the silicon ecosystem. The big questions now will be whether the deal will pass regulatory scrutiny as well as be accepted by Arm’s current customer base.

The author and members of the TIRIAS Research staff do not hold equity positions in any of the companies mentioned. TIRIAS Research tracks and consults for companies throughout the electronics ecosystem from semiconductors to systems and sensors to the cloud. Members of the TIRIAS Research team are tracking all the developments in AI and enterprise computing technology and have consulted for Arm, Nvidia and other companies focused on PCs, Graphics, AI and enterprise computing solutions.