Oil Edges Higher Ahead of OPEC+ Meeting With Demand in Focus

by Sharon Cho, James ThornhillBookmark

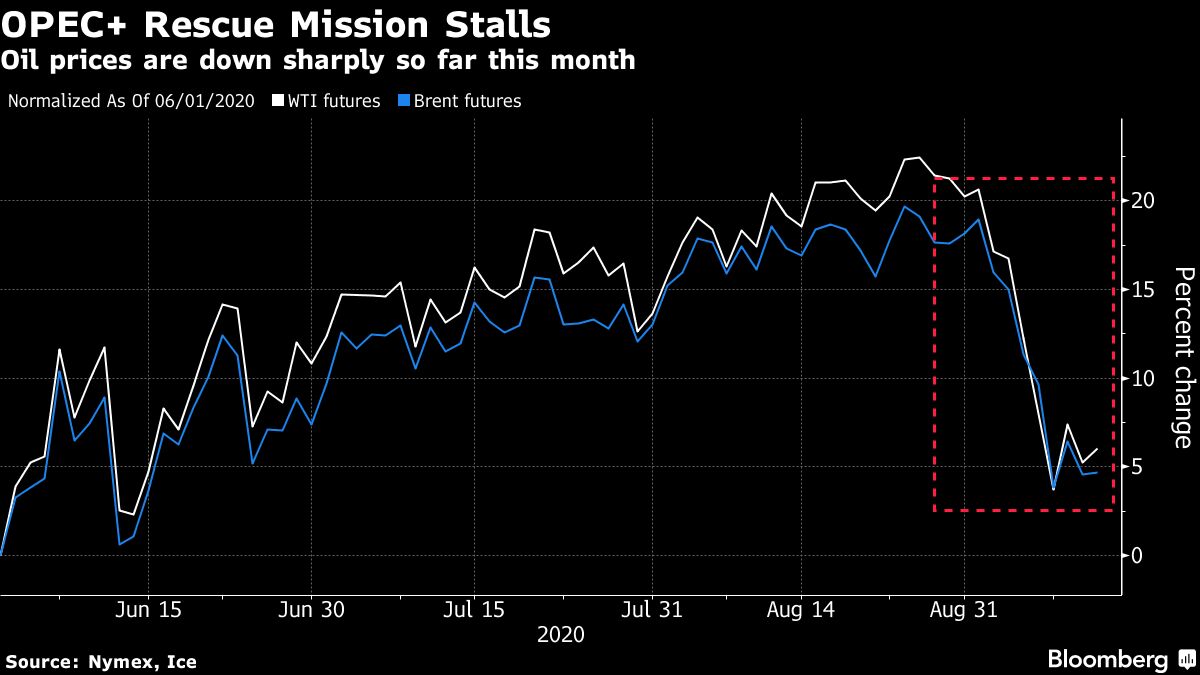

(Bloomberg) -- Oil climbed toward $38 a barrel in New York ahead of an OPEC+ meeting this week that will assess the group’s production cuts as the recovery from virus-driven demand destruction falters.

Futures rose 0.7% after capping the first back-to-back weekly loss since April. A meeting of the Joint Ministerial Monitoring Committee is set for Thursday, with the rebound stalling as OPEC+ returns some supply to the market. BP Plc said the relentless growth of oil demand is over and consumption may never return to the levels seen before the pandemic took hold.

Oil has tumbled back below $40 a barrel after staging a comeback from a rout below zero in April, with rising coronavirus infections across major economies raising doubts about a sustained recovery. There is at least a glimmer of hope that a vaccine isn’t far away, with the University of Oxford and AstraZeneca Plc saying that they have restarted a U.K. trial of an experimental drug after it was halted over concerns about a participant who fell ill.

READ: Shanghai Exchange May Add More Grades for Futures: APPEC UPDATE

“While no one is 100% sure on the course of the economic recovery, OPEC+ is being put in a tough spot as the cartel witnesses the market building a steeper contango ahead of its meeting,” said Stephen Innes, chief global market strategist at AxiCorp. “Optimist’s remain focused on the vaccine cure.”

| Prices |

|---|

| • West Texas Intermediate for October delivery rose 0.7% to $37.60 a barrel on the New York Mercantile Exchange as of 12:32 p.m. Singapore time after dropping about 6% last week • Brent for November settlement gained 0.4% to $39.99 on the ICE Futures Europe exchange after losing 0.6% on Friday |

Compliance with OPEC+ output cuts may be an issue during talks this week after new signs of exporters reneging on the deal, while a widening contango in Brent crude is indicating rising concerns about over-supply. Iraq has cut pricing for all of its crude grades to Asia and the U.S. for October following similar curbs by Saudi Arabia and other Gulf producers as demand stalls.

See also: Flagging Asian Demand Sees Oil Sellers Brace for Price Battle

Meanwhile, even BP’s most bullish scenario sees demand no better than “broadly flat” for the next two decades as the energy transition shifts the world away from fossil fuels, according to a report from the company. Vitol Group, however, predicts there will be 10 years of growth before a steady decline.

©2020 Bloomberg L.P.

Missing BloombergQuint's WhatsApp service? Join our Telegram channel or activate Website Notifications.